In a market where direction is harder to predict, many investors are looking for ways to generate steady, attractive returns without depending solely on rising stock prices.

Enter fixed coupon notes – one of today’s fastest-growing structured products that turns market dynamics into steady income, often at double-digit annualized rates.

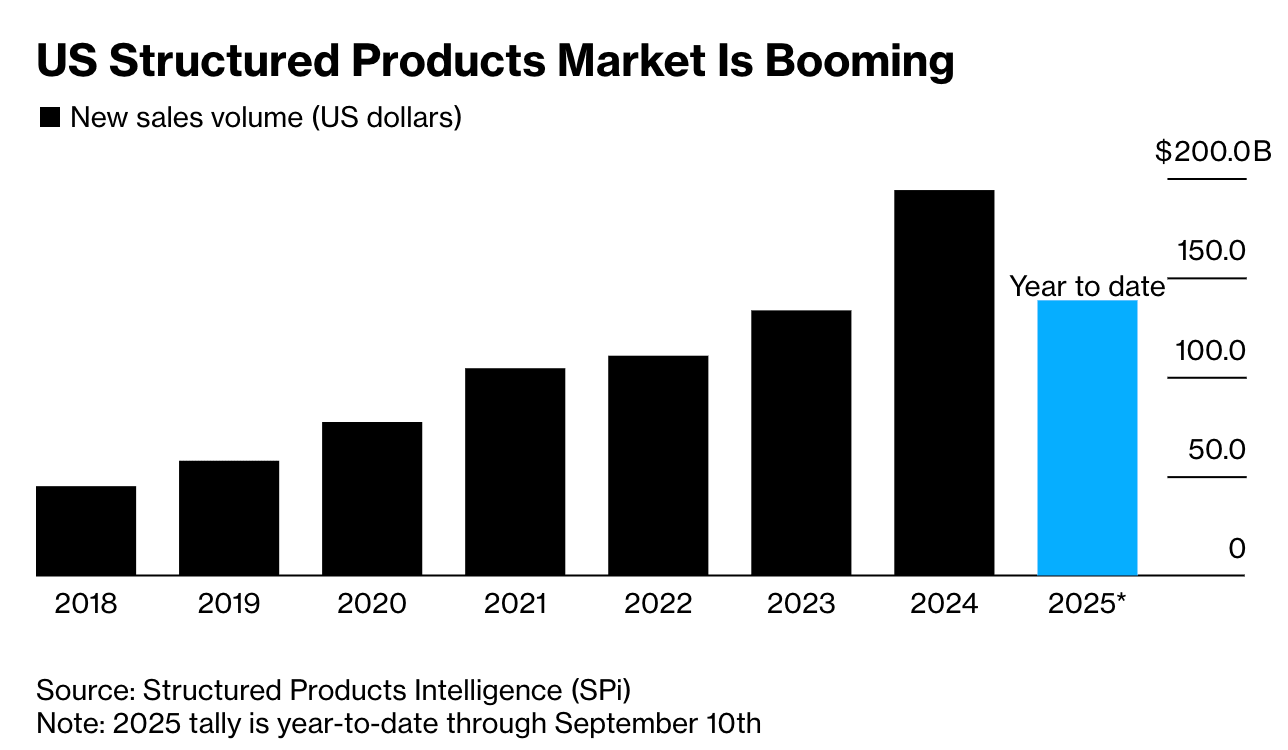

The popularity of yield-oriented notes has surged in recent years among high-net-worth investors, making up a majority of the nearly $200 billion annual U.S. structured note market1. In an environment of stretched equity valuations, declining interest rates, and macro uncertainty, investors are turning to products with defined payoffs that can potentially deliver solid, regular returns even in less predictable markets.

How fixed coupon notes work

These structured products are designed to deliver regular income like a bond. They pay out a fixed yield each month – regardless of what happens with the underlying stocks or broader market.

But unlike a traditional bond, the final return of principal is linked to the performance of one or more stocks. In exchange for taking on some market risk, fixed coupon notes can offer much greater income potential than high-yield savings accounts or traditional fixed income.

To evaluate a note or structure your own (a feature now available to Arta members), it’s important to know the different terms. Here’s a breakdown of exactly how they work:

Three key components

1. Term

Maturity

These products typically run for 3 to 12 months, making them shorter-term instruments compared to traditional bonds.

Callability

Many fixed coupon notes include an “autocall” feature, meaning they can terminate early if certain conditions are met – often when the underlying stocks have performed well. While early termination means you stop receiving coupons, you get your full principal back and can redeploy capital.

Callable structures often deliver higher yields because they limit the issuer's exposure to extended periods of paying above-market coupons.

Payment interval

Most notes pay out income monthly, though quarterly payment structures exist as well.

2. Underlying asset(s)

Fixed coupon notes can be linked to a wide range of assets, including stocks, ETFs, commodities, or currencies. In practice, most are tied to a basket of 1-4 stocks.

The volatility of those underlying assets is a key driver of yield levels – higher volatility generally translates to higher offered yields, though it can also mean higher risk of principal loss if markets move unfavorably.

3. Downside protection

The most critical aspect of these notes is understanding exactly how your principal is protected – or exposed.

Downside barrier

Your return of principal is conditioned on each stock staying above a certain threshold at maturity (e.g. 70% of its initial price). This is the barrier – as long as no stock breaks the barrier, you receive your full principal.

However, if any stock ends the term below the downside barrier, your return is tied to the lowest performer and your principal will be reduced.

Downside buffer (or discount price)

The degree to which your principal is reduced depends on the downside buffer. It determines how much of a cushion you get before you start being exposed to losses.

This can also be called the “discount price,” as it represents the discount at which you effectively bought the stock relative to today's price.

In practice, the buffer and barrier are often set at the same level – for instance, 30%. This means if an asset is down more than 30% at maturity, your first 30% of downside is absorbed by the buffer, and you're only exposed to losses beyond that 30% threshold.

Final step: Securing the optimal yield

Once the note structure is set, investment managers like Arta generally “auction” the terms to several major investment banks – such as Morgan Stanley, UBS, and J.P. Morgan. This competitive process helps ensure investors are getting the most competitive yield available.

Case Study

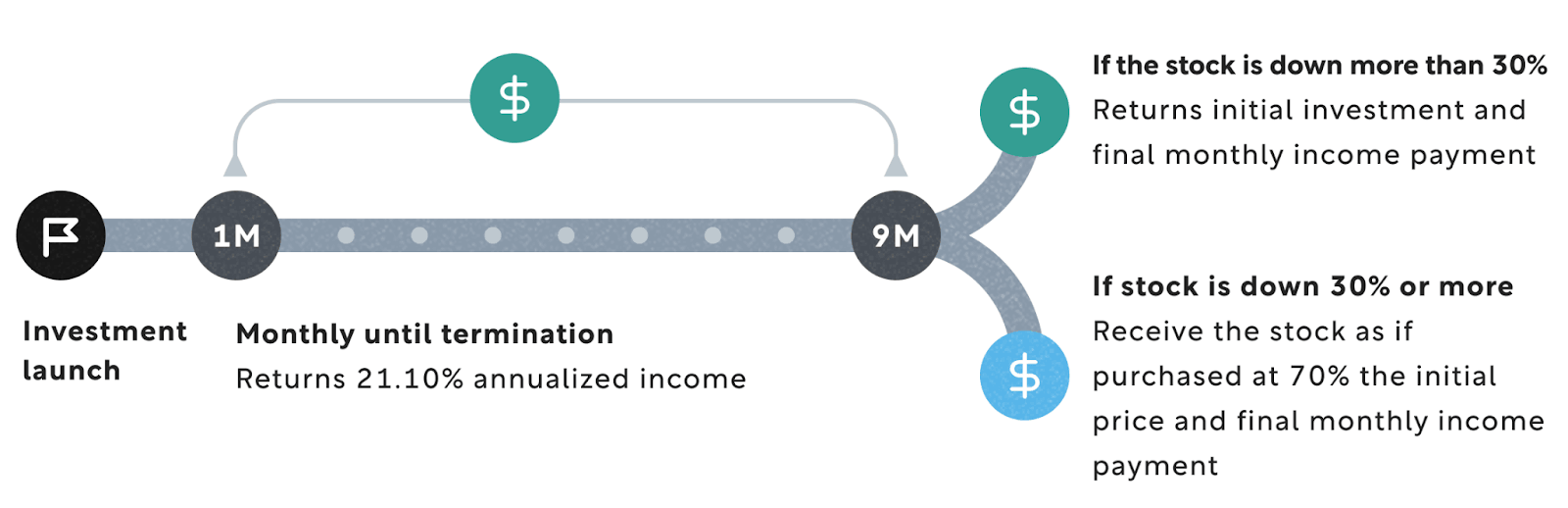

Here’s an example of a structure recently offered on Arta.

Maturity: 9 months (callable starting at 3 months)

Asset: Moderna (MRNA)

Downside protection: 30%

Yield: 21.10% p.a. (~1.76% monthly coupon)

This structure provides attractive monthly income, full principal repayment if the stock ends the term above the barrier, and exposure only if the stock finishes down more than 30%.

The fixed coupon note structure offers an appealing middle ground for investors seeking more income than the company’s bonds can provide, without taking on the full volatility and risk of owning the stock outright.

Frequently Asked Questions

1. Are income payments conditional or guaranteed?

Standard fixed coupon notes offer contractual yield – you receive your monthly or quarterly income payments regardless of what happens with the underlying stock(s). The only scenario in which you would not receive these payments is if the issuer defaults on its obligations. To mitigate this risk, Arta exclusively partners with major, investment-grade banks.

2. How can these notes achieve such attractive yields?

Fixed coupon notes generate income from option premiums on the underlying stocks or indices. Essentially, investors trade a bit of future upside potential for steady, higher income today. Because more volatile assets tend to have higher option premiums, these notes can offer enhanced yields with defined risk parameters.

3. Who are fixed coupon notes appropriate for?

Fixed coupons notes can be appropriate for:

Market-savvy investors with convictions around particular stocks or indexes.

Income-focused investors looking for regular monthly payouts with some level of built-in downside protection.

Investors seeking diversification or alternatives to traditional fixed income investments, with the potential for higher returns.

4. What are the risks?

There are three primary risks to consider:

Credit Risk: These products are issued by investment-grade banks or financial institutions. Your investment is legally a bond of the issuer, so if the issuing bank were to default, your principal and coupons could be at risk.

Market Risk: If stock prices fall significantly, you may end up losing your principal.

Liquidity Risk: Structured products are generally designed to be held to maturity, and exiting early could mean selling at a discount.

5. What are the minimum investment requirements?

The minimum investment on Arta starts at $25,000. It’s free to sign up but members must qualify as Accredited Investors.

Explore structured income opportunities with Arta

Platforms like Arta offer both pre-structured Yield offerings with competitive terms and the ability for members to design custom notes tailored to their specific views and risk parameters.

Create your Arta account to explore our live offerings. You can also check out our other articles to learn more about structured products:

Fixed Coupon Notes: Understanding the Levers for Higher Returns

Structured Notes, Demystified: 10 Things Investors Should Know

1 Source: Structured Retail Products (SRP), “US Market Review, July 2025”

Do you want in?

Create an account in an instant

Sharing is caring

Disclosures

We believe the information presented to be accurate as of the date published and such information may not be updated in the future.

The information contained in this communication is provided for general informational purposes only, and should not be construed as investment or tax advice. Nothing in this communication should be construed as a solicitation, offer, or recommendation, to buy or sell any security.

Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Arta Finance or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Copyright Arta Finance 2026. All rights reserved.

Get the latest market trends and investment insights