Custom Fixed Coupon Notes: Understanding the Levers for Higher Yields

August 27, 2025

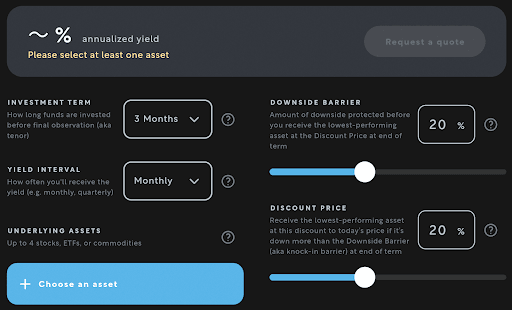

Fixed Coupon Notes (FCNs) are gaining traction among investors seeking steady income and more control over how they take risk. With tools like Arta’s Custom Yield Builder, investors can tailor structured notes to their specific market views and goals.

If your goal is to pursue higher yields, which design choices matter most?

This article explores the practical levers you can pull to potentially increase the yield on your custom FCNs. For each lever, we’ll cover the rationale behind it and potential tradeoffs.

A quick but important note: Maximizing yield often means giving up something else, like protection, flexibility, or duration. The most effective structures are those aligned with your own market conviction and risk tolerance, not just the highest headline number.

How Fixed Coupon Notes Work

At its core, a Fixed Coupon Note is a type of structured note that pays a regular, fixed income payment (the "coupon").

Think of it like a bond: You invest a certain amount of principal, and in return, a major bank agrees to pay you a regular, fixed coupon for a set period.

At maturity, your repayment of capital is contingent on the performance of an underlying asset – typically a stock or a basket of stocks. If the worst-performing stock ends below a specified barrier, your repayment will come in the form of discounted shares rather than cash.

Here’s a snapshot of how the different levers in a custom fixed coupon note work:

Five Levers to Pull for Higher Potential Yields

If you’re customizing a fixed coupon note and are curious what changes might help increase your yield potential, here are a few ideas you can consider.

1. Choose higher-volatility assets

When a stock has been swinging sharply, the options market often prices that in to continue – driving up implied volatility. This makes the options in an FCN more valuable, which boosts your yield potential.

Yields can get an extra boost when options pricing is distorted by supply and demand imbalances, resulting in skew – e.g. from strong bullish or bearish sentiment.

2. Combine multiple, low-correlation assets

When stocks have shown low historical correlation, issuers tend to assume they’ll continue moving independently — increasing the odds that one will underperform. This can result in higher yields, particularly after recent dislocations or sector-driven divergences.

If you're bullish on two names from uncorrelated sectors – or believe that recent stock-specific events will fade and performance will converge – combining them in a single note may deliver a potential boost in yield compared to a single-asset note.

3. Reduce downside protection

Downside protection helps limit your losses, but also caps your yield potential. Reducing that protection level exposes more of your principal while raising your potential income.

This lever works best when you’re confident in the underlying assets or when you’re willing to take on a bit more equity-like risk in exchange for higher coupons.

4. Add a callable feature

Callable notes let the issuer redeem the note early, often after a brief no-call period. That optionality is valuable to them because it limits their exposure, so they’ll often offer you more yield in return.

Typically, the shorter the call window, the greater the boost – though that’s not always the case. You may not receive all the planned coupon payments if the note is called, but for income-focused investors, the tradeoff is often worth it as you can quickly reinvest into a new note.

5. Experiment with term length

Time horizon plays a subtle role. Shorter terms often produce higher annualized yields, especially when callable, since the issuer’s exposure is more limited.

But it depends on the market. In certain interest rate or credit spread environments, notes of up to a year can potentially be more attractive. It can be worth testing both ends of the spectrum to see where yield peaks.

How Yield and Safety Interact

Finding the right balance of yield potential and protection is key to designing the right fixed coupon note for your needs. Here are the options to consider in each direction.

Customization Lever | To Increase Yield (Higher Risk) | To Increase Safety (Lower Yield) |

|---|---|---|

Underlying Asset | Use a volatile stock or sector | Use a low-volatility blue chip |

Downside Barrier | Set a higher barrier (e.g., 80% of start price) | Set a lower barrier (e.g., 60% of start price) |

Callability | Choose a short call period (e.g. 1 month) | Make the note non-callable |

Key Risks to Keep in Mind

Designing for higher yield means understanding the risks you're taking on:

Principal Risk: If the underlying asset breaches the knock-in barrier and stays below it at maturity, you could receive depreciated shares.

Liquidity Risk: These notes are typically designed to be held to maturity. Secondary market access is limited and may result in losses.

Call Risk: Early redemption may cut short your coupon stream and force reinvestment in a different rate environment.

Custom FCNs can be a smart fit for investors seeking higher income, who are neutral-to-bullish on specific assets, and who are comfortable holding to maturity. With the right tools and guidance, you can shift from passive buyer to strategic builder – constructing yield-focused investments that reflect your unique outlook.

If you’d like to speak with an expert at Arta Finance about how to customize your own fixed coupon note, we’re here to help.

Do you want in?

Create an account in an instant

Sharing is caring

Disclosures

We believe the information presented to be accurate as of the date published and such information may not be updated in the future.

The information contained in this communication is provided for general informational purposes only, and should not be construed as investment or tax advice. Nothing in this communication should be construed as a solicitation, offer, or recommendation, to buy or sell any security.

Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Arta Finance or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Copyright Arta Finance 2026. All rights reserved.

Get the latest market trends and investment insights