Take the next step towards building your financial future

The current economic uncertainty is making you wonder if there’s more you can do to further optimize your finances. Your 401K and Roth IRA? Maxed out. Got into ETFs? Check. You’re ready to move on to the next level – but what is that next level, exactly? What are some additional products and strategies you should consider for managing, growing, and protecting your finances during these times?

We created Arta to help break down the high barriers to sophisticated finance. Our aim is to empower you with “financial superpowers” by lowering entry minimums to exclusive opportunities, using artificial intelligence to optimize your portfolio (around the clock and incorporating more inputs than a human financial advisor ever could!), and offering additional services like tax advisory, insurance services, lines of credit, and administrative support – all in one place.

In this post, we’ll introduce two financial strategies Arta can help you with – with more “financial superpowers” to come in our next instalments.

Diversify your portfolio with private market investments

Manage volatile public markets with artificial intelligence

Diversify your portfolio with private market investments

Besides investing in traditional asset classes in the public markets (like stocks and bonds), qualified investors also invest in private investments (also known as alternative investments). Examples of private investments include private equity, private credit, venture capital, and real estate. They can also include unique assets such as art or wine.

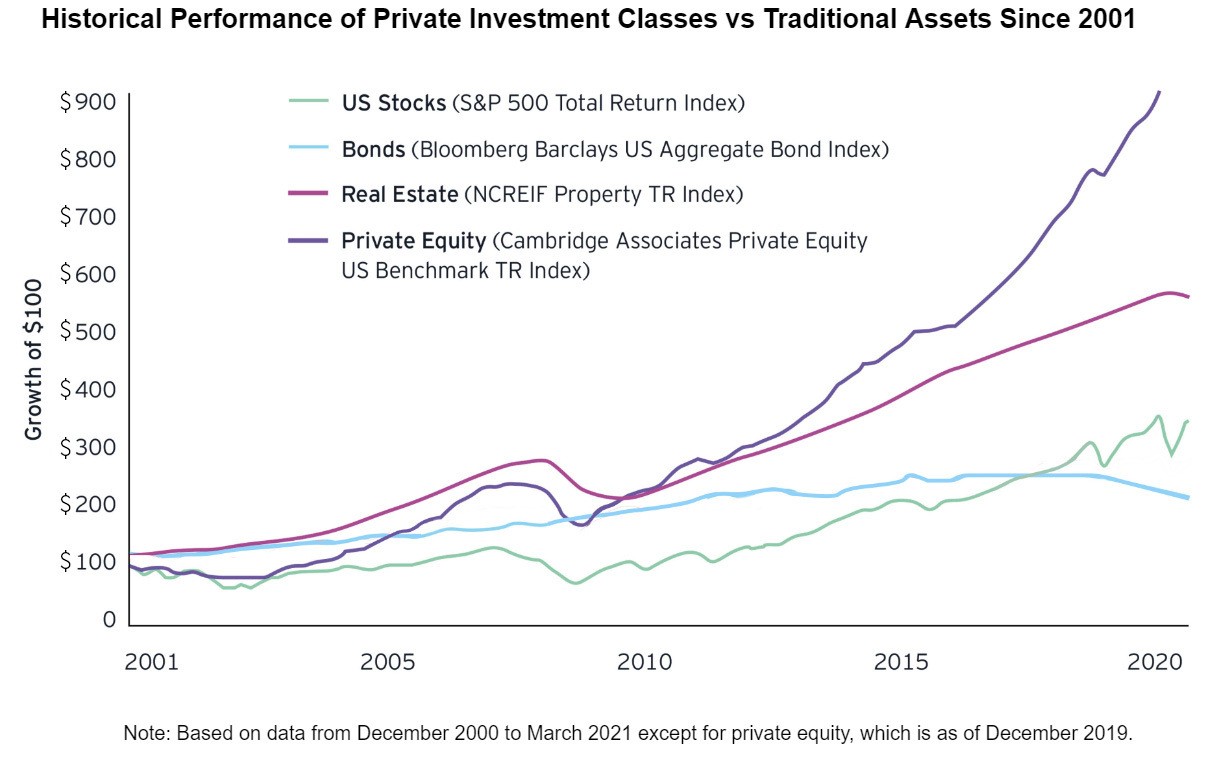

Sophisticated investors often invest in private investments to diversify their portfolio. Private investments can be a strong addition to an investment portfolio, since they have the potential to provide higher returns than public markets and tend to have low correlation to public market volatility. As seen in the chart below, private equity and real estate have outperformed US stocks and bonds significantly from 2001 to 2020.

Private investments can be a strong addition to an investment portfolio, since they have the potential to provide higher returns than public markets and tend to have low correlation to public market volatility.

Despite the potential advantages, access to private investments like private equity or private credit can be limited. While sophisticated investors, like the ultra-rich, allocate as much as 50% to these alternative assets1, the average investor typically only invests 5% of their portfolio in these asset classes2. One of the reasons? Minimum investments start at hundreds of thousands or even millions of dollars.

Arta seeks to make private investments more accessible to more people by lowering the minimums. To start, we have sourced private investment opportunities that start as low as $2,500. Over time, we will continue to help our members find more opportunities that meet our high research and due diligence standards.

Next Step: Learn more about the different types of private investments

Private equity and real estate (two types of private investments) have outperformed US stocks and bonds significantly from 2001-20203

Manage volatile public markets with artificial intelligence

Many sophisticated investors know that The Holy Grail of investing is a portfolio with positive returns and lower risk. Looking at historical returns is just one part of the picture – Sophisticated investors also focus on risk-adjusted returns. In other words: They aim to maximize potential gains for the lowest level of risk or volatility.

In today’s market, managing volatility is extremely important. Unfortunately, very few everyday investors have the expertise or time to actively navigate the nuances of risk. Sophisticated investors have the money, technology, and teams of financial advisors who can help them with this 24/7 – but what about the rest of us?

We believe artificial intelligence (AI) and machine learning can help manage risk systematically, when humans don’t have the expertise, the time, or the resources to do so.

Arta’s answer is AI-Managed Portfolios (we call them “AMPs”). We believe artificial intelligence (AI) and machine learning can help manage risk systematically, when humans don’t have the expertise, the time, or the resources to do so. Unlike automated products or services like ETFs (Exchange-Traded Funds), direct indexes, and robo-advisors, our AI models are trained by vast financial datasets and tested against different scenarios to ensure they are resilient and responsive.

With the help of AI, AMPs can systematically deal with market volatility by cushioning drawdowns. It is this continuous reduction of the “dips” that enables AMPs to accrue gains that can add up and potentially compound over time.

Next Step: Learn more about how AMPs work.

Unlock “financial superpowers” with your Arta “digital family office”

Ultra-high-net-worth investors have an advantage when it comes to investing their money. In fact, some ultra-high net worth folks have family offices, or teams of financial professionals dedicated to managing their wealth. But the gap is starting to close, thanks in part to the leaps in technology like artificial intelligence.

Arta is building a “digital family office” that makes wealth creation strategies accessible to more people than ever before. We are on a mission to empower our members with access to private markets or sophisticated public market investment techniques. If you’re interested in learning more, become a member today.

Next Step: Watch a two minute overview of what we’re building at Arta 👇.

Footnotes

Do you want in?

Create an account in an instant

Sharing is caring

Disclosures

We believe the information presented to be accurate as of the date published and such information may not be updated in the future.

The information contained in this communication is provided for general informational purposes only, and should not be construed as investment or tax advice. Nothing in this communication should be construed as a solicitation, offer, or recommendation, to buy or sell any security.

Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Arbo Works or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Copyright Arta Finance 2025. All rights reserved.

Get the latest market trends and investment insights