Investing in private markets has typically been a cornerstone strategy of the ultra-wealthy. With the help of modern tools (like Arta’s), this highly valuable asset class is available to investors like you.

What are private investments?

Private investments, often referred to as alternative investments or “alts”, are financial assets outside of public market asset classes of stocks, bonds, or cash. These investments tend to have different return, risk, and liquidity attributes than traditional investments and are often included as part of a holistic investment strategy.

Growth in private markets has moved at a staggering rate, outpacing growth in public markets since the Global Financial Crisis, with the amount of assets invested in alternatives expected to reach $14 trillion in 20231.

Key Takeaways

Private investments are financial assets outside of public market asset classes of stocks, bonds, or cash.

Real estate, private equity, venture capital, or private credit are all examples of private investments.

High net worth individuals typically have higher allocations in alternative investments due to their unique attributes, which can include high returns, lower correlation to public markets, and diversification.

Arta enables access to alternative investment opportunities that have historically been out of reach for most investors by establishing direct relationships with fund managers and aggregating smaller investments.

Why invest in private markets?

While complex, private investments are valued by many types of investors due to their unique attributes:

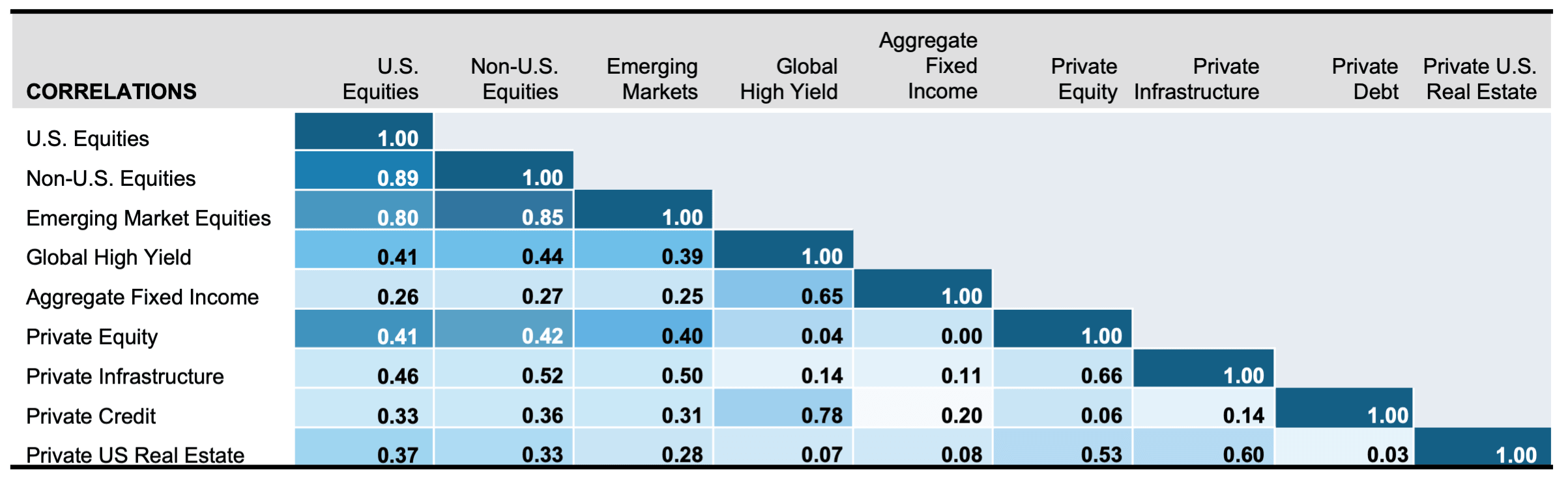

Low correlation to traditional assets: Many private market asset classes have low correlation to the stock market and traditional assets, which may lead to more stable returns during market fluctuations. According to the following correlation analysis by Russell Investments2, private equity, private credit, and real estate historically have less than 50% correlation with US equities.

For illustrative purposes only.

Diversification: Because of this lower correlation, introducing private asset classes can help diversify a portfolio, reducing the overall risk.

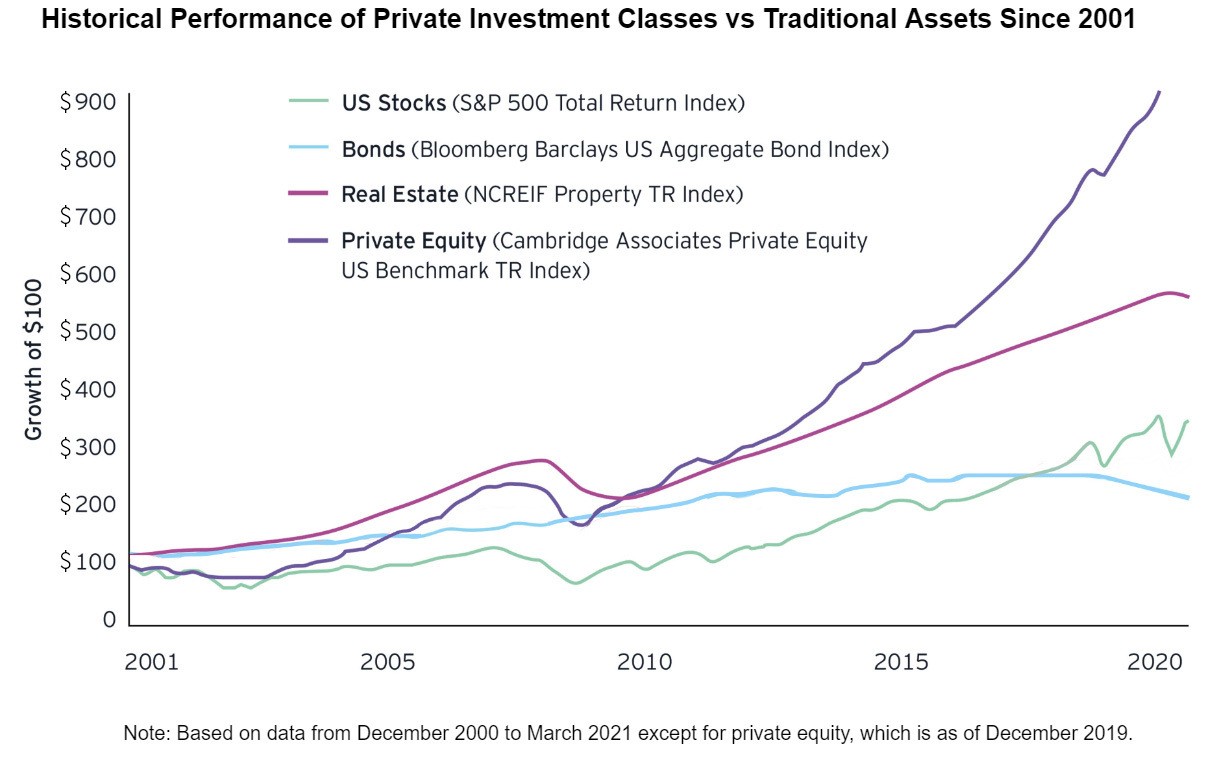

Returns: They can also offer the potential for higher returns, particularly in low yield environments and economic downturns. For example, private equity funds have outperformed public equities and many other asset classes by multiples since 20003, as shown in the chart below.

For illustrative purposes only.

Inflation hedge: Some asset classes, such as private credit and real estate, have a tendency to hold their value during inflationary periods, acting as a hedge against inflation.

Unique opportunities: These asset classes provide access to investments and opportunities that may not be available in traditional markets.

Who typically holds private investments?

Over the past 20 years, institutional investors (such as institutional/multi-family offices, pension funds, endowments, and insurance companies) and ultra-high net worth individuals have outperformed retail investors, largely driven by a higher allocation in private investments. Historically, institutional investors tend to be the primary investors of private investments because of the greater level of complexity, high minimums, and illiquid nature of these asset classes. Private asset classes such as private equity and hedge funds comprise around 50% of institutional investor portfolios, compared to only 6% for individual investors.

Many investors rely on private market asset classes to help increase their portfolio returns. According to a 2022 Bank of America Private Bank study, 75% of high-net-worth investors between the ages of 21 and 42 say it’s impossible to achieve above-average returns solely with traditional stocks and bonds4.

High net worth individuals typically have higher allocations in alternative investments due to their unique attributes, which can include high returns, lower correlation to public markets, and diversification.

Some common types of private investments include:

Real estate: This includes investing in residential or commercial property, either directly by owning a property or indirectly through a real estate investment trust (REIT). Real estate can offer potential for income through rent and appreciation, but it also involves significant upfront costs and ongoing expenses. It can be a way to generate passive income through rent payments and potentially benefit from long-term appreciation in property values.

Private equity (PE): This refers to ownership stakes in privately held companies that are not publicly traded on a stock exchange. Private equity firms often look to buy and improve underperforming companies, and then sell them for a profit. Some investors may be attracted to private equity as a way to potentially generate higher returns, but it is a long-term investment that requires a high level of risk tolerance.

Private credit: This refers to loans made by private investors to businesses that cannot or do not want to access public markets (or traditional providers such as banks) for their capital needs. Private credit can offer higher yields than traditional fixed income investments due to its risk and liquidity characteristics, and can act as an inflation hedge when issued with floating rates. Private credit tends to be less risky than stocks, but may be riskier than traditional debt and may not be as liquid as publicly traded bonds.

Venture capital (VC): VC is a subset of private equity that typically focuses on investments made in startups or companies in various early-stages with the potential for high growth. Because of this profile, venture capital investments tend to have high returns when successful, but also high uncertainty and high rates of failure.

Hedge funds: These are professionally managed investment funds that employ a variety of strategies, including leverage, derivatives, and short selling, to generate returns. Hedge funds are generally considered to be more aggressive, risky, and exclusive than mutual funds. They typically invest in liquid assets and are usually open-ended, meaning investors can invest and withdraw money periodically. Many hedge funds aim to deliver positive returns in both bull and bear markets through complex strategies.

Why don’t more people invest in private investments?

Many people do not invest in private investments because of the complexity involved, low familiarity with the factors involved, or the inability to get access to them. Some of the major considerations include:

Access: Some investments and asset classes are limited on a basis of minimum requirements or relationships. For instance, many private equity funds do not accept investors who do not have at least $5 million in invested capital. Arta aims to improve access to investment opportunities for investors.

Investment goals: Private asset classes may be more or less suitable for different investment goals depending on their characteristics. For example, private credit tends to be a good fit for income generation, while collectibles tend to be a poor fit for constant liquidity needs.

Risk tolerance: Private investments have a wide spectrum of risk, both above and below traditional investments. For instance, private equity and real estate investments tend to experience significantly lower volatility than public stocks, however cryptocurrencies can easily multiply or lose most of their value in a year. It is important to match an investment’s risk profile with the goals of the broader portfolio.

Liquidity: Private investments can be less liquid than traditional investments, which means that it may be difficult to sell them quickly or that there may be a lack of buyers in the market. For example, while real estate may have the opportunity to significantly grow in value over time, it may be more challenging to liquidate than 100 shares of Google.

Timing of cash flows: For some private investment classes, it may be difficult to predict the outflow or distribution of cash. For example, the cash flows of many private equity commitments follow what is called a “J-Curve”, with cash outflows happening in initial years, and distributions that may not begin for several years post-commitment. It’s important that the expected cash flow profile of each investment type matches your needs.

Fees and expenses: Private investments often have higher fees and expenses than traditional investments due to their unique nature and high level of expertise involved. These fees can be more challenging to navigate than for traditional investments - for instance, many private funds may charge a management fee on assets under management, an incentive fee on gains, and pass through operating costs to investors.

Regulatory environment: Private investments can be subject to different regulatory environments than traditional investments, which can affect the investment's safety, transparency, and governance.

Investment manager: Private investments often require more specialized knowledge, and it's important to work with an advisor or manager who has experience in this area. Make sure to do your due diligence on the investment advisor/manager and their track record.

THE ARTA ADVANTAGE

Private investments have long been the go-to strategy for the ultra-rich, and with Arta, these exclusive tools are now more accessible.

Arta's goal is to empower individuals by offering access to the same wealth-growing and preservation strategies utilized by the wealthiest individuals. Arta helps to:

Provide access to investment opportunities by aggregating smaller investments and making direct relationships with fund managers

Break down hidden fees and fine print so you can understand them in plain english

Perform due diligence and identify pros/cons of each opportunity to make an informed decision

Run each alternative investment opportunity through a rigorous selection process and internal investment committee before offering to our users

Private investments can be a great way to improve the risk, return, and diversification profile of a portfolio. So, are they right for you? It is important to carefully consider your financial goals and risk tolerance before deciding to invest in alternatives. And if you need help with that, consider learning more about alternative investing with Arta Finance. We're here to help.

Footnotes

- Preqin, The Past Present and Future of the Alternative Assets Industry

- Ernst & Young, Global Investment Performance Standards: considerations for alternative managers, 2021

- Russell Investments, New private markets strategies to support your total portfolio, 2022

- Bank of America, Private Bank Study of Wealthy Americans, 2022

Do you want in?

Create an account in an instant

Sharing is caring

Disclosures

We believe the information presented to be accurate as of the date published and such information may not be updated in the future.

The information contained in this communication is provided for general informational purposes only, and should not be construed as investment or tax advice. Nothing in this communication should be construed as a solicitation, offer, or recommendation, to buy or sell any security.

Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Arta Finance or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Copyright Arta Finance 2026. All rights reserved.

Get the latest market trends and investment insights