Automatic Diversification

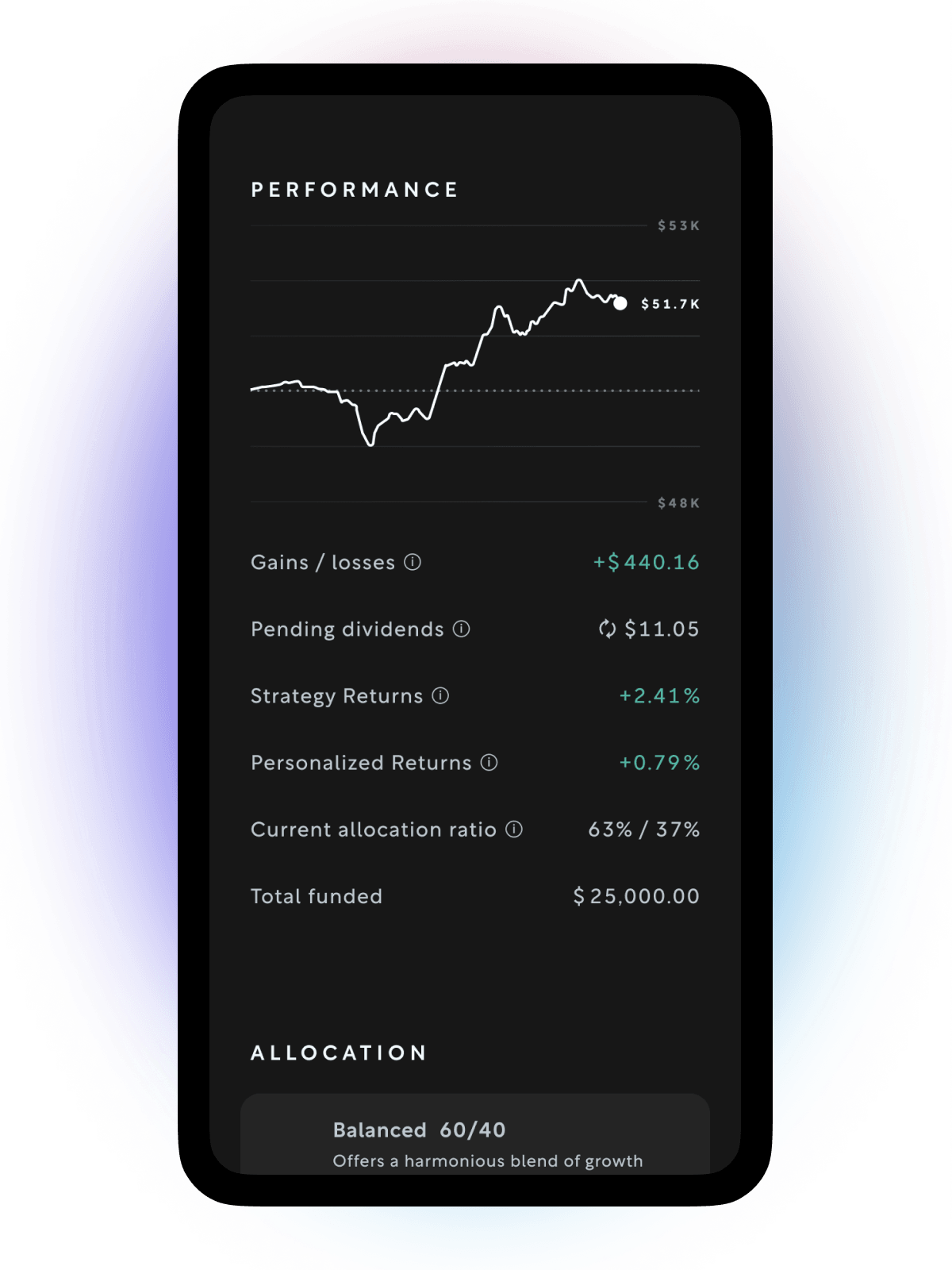

Invest in a diversified portfolio composed of stock and bond ETFs

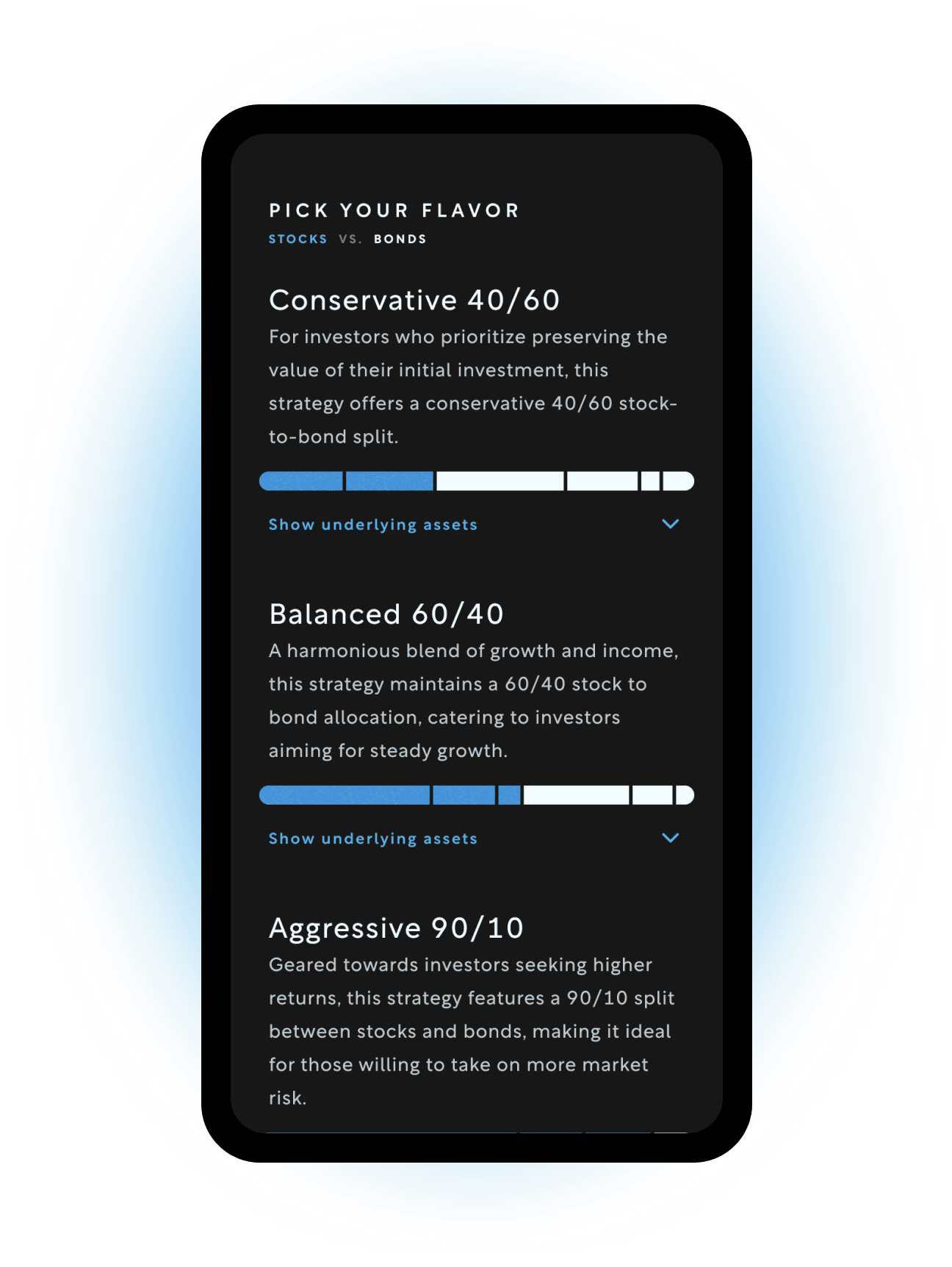

Risk Levels To Match Your Goals

Choose a conservative, balanced or aggressive strategy, and we’ll rebalance automatically to keep you on track

Low Cost

0.1% advisory fee - less than half the fees of leading robos. Keep more of your returns with low-cost ETFs

Tax Efficient

Automatic tax-loss harvesting can help you accumulate tax deductions - at no extra cost.

How Arta Robo Automated Investing Works:

1. Tell us about your goals

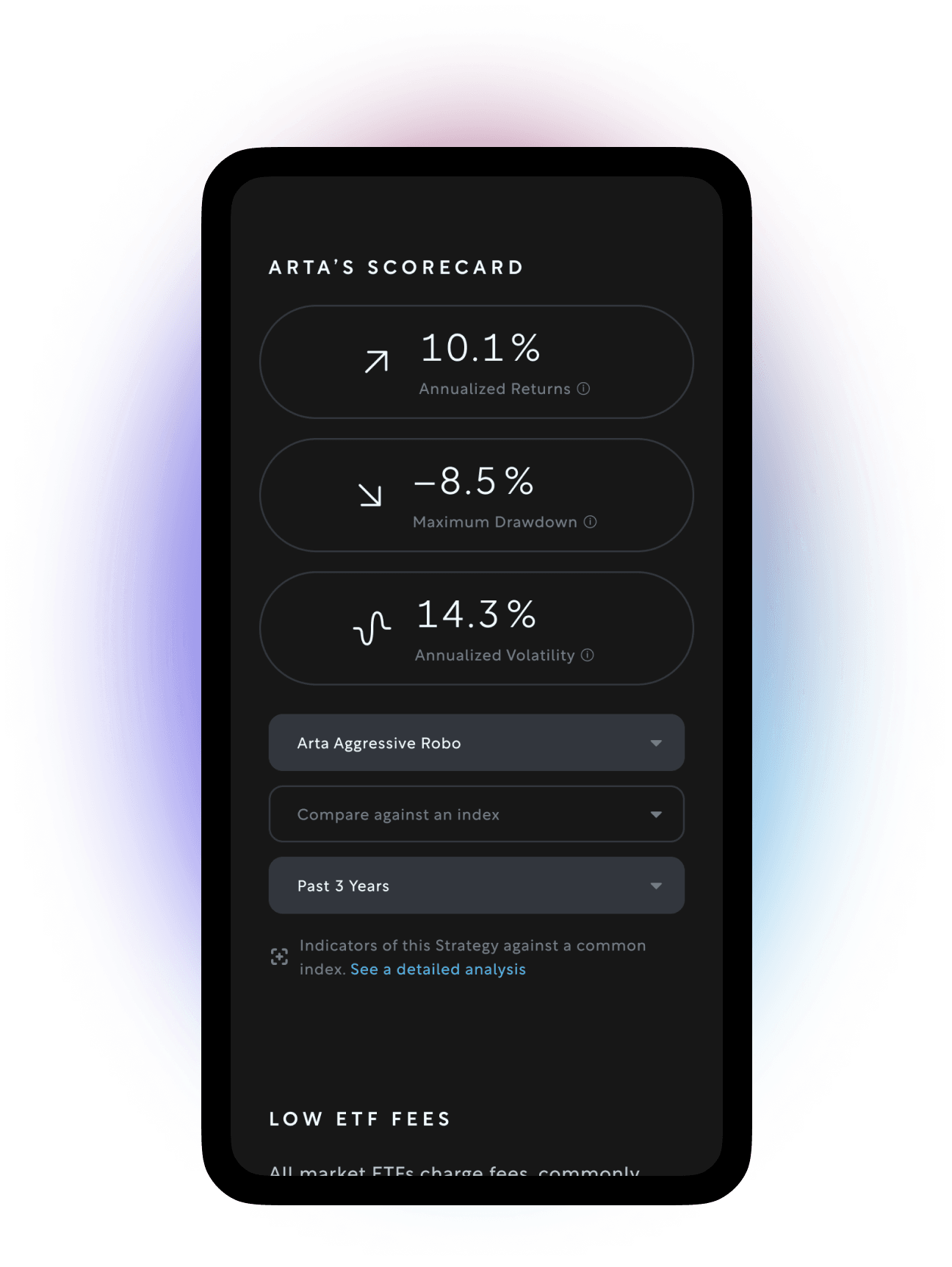

Arta's Robo offers three distinct risk levels: Conservative, Balanced, and Aggressive. Each level utilizes the same asset universe but varies in its stock/bond allocation to suit different risk appetites. The overarching goal is to maintain a diversified portfolio in a highly cost-effective manner.

2. We’ll create your portfolio

Arta's investment team then carefully selects from a diverse range of broad market index ETFs, prioritizing those with the lowest expense ratios in their respective asset classes.

3. Stay on track with constant monitoring

Arta’s team of experts monitors your portfolio daily and automatically rebalances to adhere to your investment objectives.

Don’t invest your money into paying fees

0.1% Advisory Fee

Less than half of most other Robos

$0 Fee on First $100,000 invested

For the life of that investment

No fees

Open your account for free!

Tax-Loss Harvesting Built In. Your Accountant May Kiss You.

Tax-Loss Harvesting is a way to potentially reduce the taxes you pay by balancing capital gains and losses. And Arta’s Robo does this automatically. Considering the historical average tax-loss harvesting benefit of 1-2%, the value of tax-loss harvesting alone could be 10 to 20 times Arta’s advisory fee.

Arta Robo | Betterment | Wealthfront | Fidelity Go® | |

|---|---|---|---|---|

Advisory Fees | 0.10% | 0.25% | 0.25% | No advisory fee <$25,000. 0.35% per year $25,000> |

Tax-Loss Harvesting | ✅ | ✅ | ✅ | - |

Phone / email support from U.S. based service professionals | ✅ | - | - | - |

Option to access Registered Investment Advisor | ✅ | - | - | - |

Got questions? We have answers

Get the latest market trends and investment insights