Infrastructure has climbed to the forefront as investors look to shore up their portfolios with resilient, tax-advantaged assets that can help offset inflation, navigate geopolitical shifts and market volatility, and align with long-term growth trends. From power grids to data centers, infrastructure assets provide the services that keep economies running—regardless of market cycles.

In an environment where stocks can swing wildly and cash loses ground to inflation, private infrastructure offers a rare combination of potential stability, tax-efficient income, and long-term upside. But how do these investments actually work? What are the trade-offs and what risks should investors consider?

Here are six things you should know about private infrastructure investing.

How private infrastructure generates income

Most private Infrastructure funds aim to generate steady, long-term cash flows by owning essential assets that are used by customers and people with recurring demand. These infrastructure assets often earn revenue through user fees, contracts, or utility rates. For example, a data center leasing bandwidth to telecoms, or a renewable energy plant signing a long-term power purchase agreement.

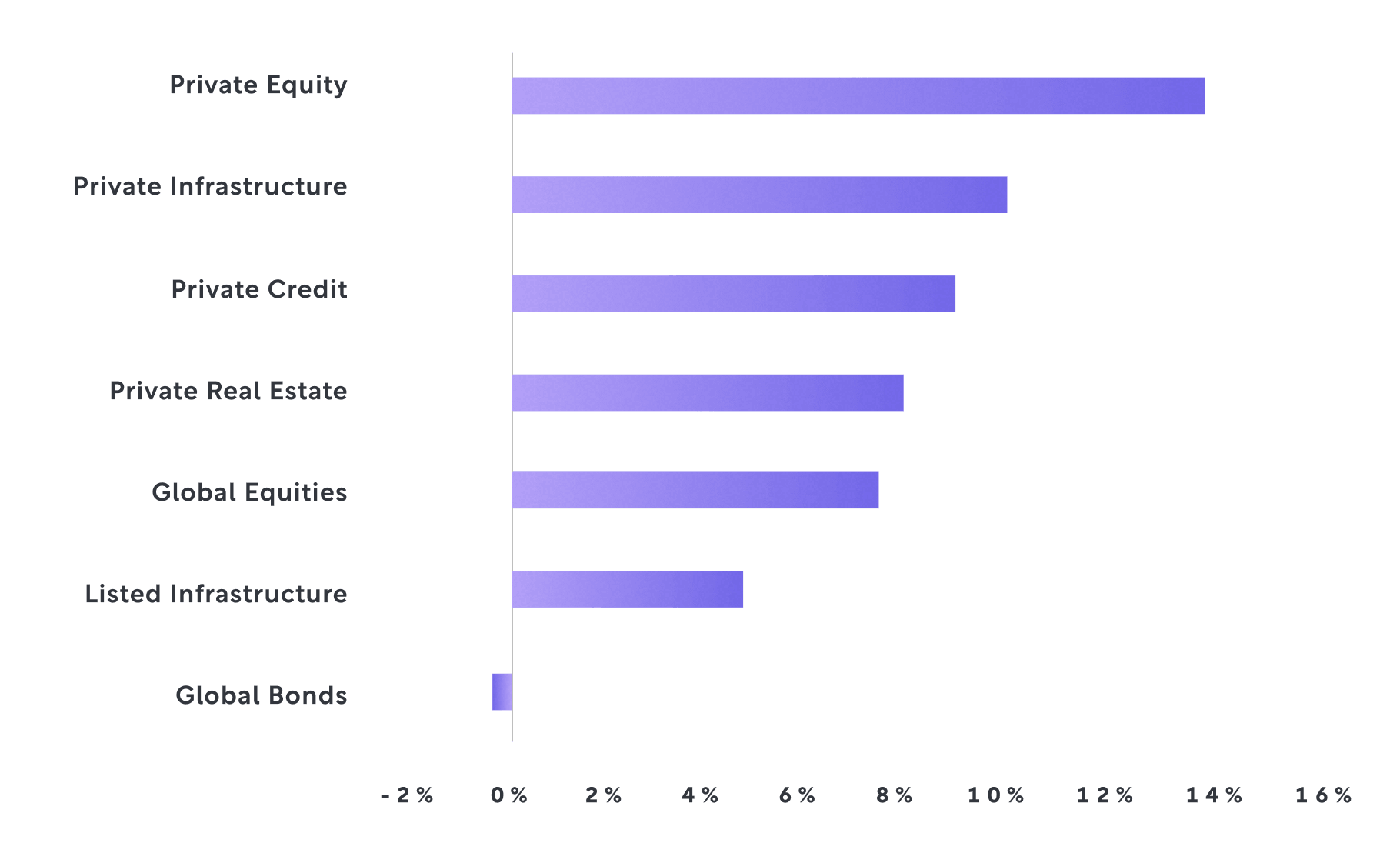

Recent research from KKR shows that over the past decade, private infrastructure outperformed every major asset class except private equity, making it a powerful engine for wealth creation in portfolios.

How infrastructure may offer meaningful tax advantages

When it comes to income generation, US investors are often looking for strategies that maximize after-tax returns and reduce unnecessary tax burdens. For example, in Arta’s recent infrastructure fund info session, the majority of attendees said that they’re interested in the fund because of tax advantages. Private infrastructure investments often have tax-efficient structures that ease the burden. Some funds offer return of capital distributions, meaning part of the cash you receive isn’t immediately taxed.

Another benefit is depreciation shields. Many infrastructure assets qualify for accelerated depreciation, allowing fund managers to pass through larger deductions to investors early on. As a result, investors can reduce the taxable income reported to them, even while the asset is still generating steady cash flow.

Plus, when infrastructure assets are held for longer than a year, any appreciation may qualify for long-term capital gains treatment, which is often taxed at lower rates than ordinary income. Some infrastructure projects, especially those tied to clean energy or digital expansion, may also qualify for government incentives like tax credits, giving investors another way to boost their potential returns.

Infrastructure as a tool to hedge against inflation

One of infrastructure’s most compelling features is its ability to protect against inflation. Many assets operate under long-term contracts that include inflation escalators, which mean that their revenue grow along with inflation rates.

Because infrastructure assets are essential to societal function, the demand for these assets are less likely to be affected by inflation or other economic shocks. Additionally, infrastructure has historically delivered real returns even during inflationary regimes and low rate environments, helping increase resilience in your portfolio.

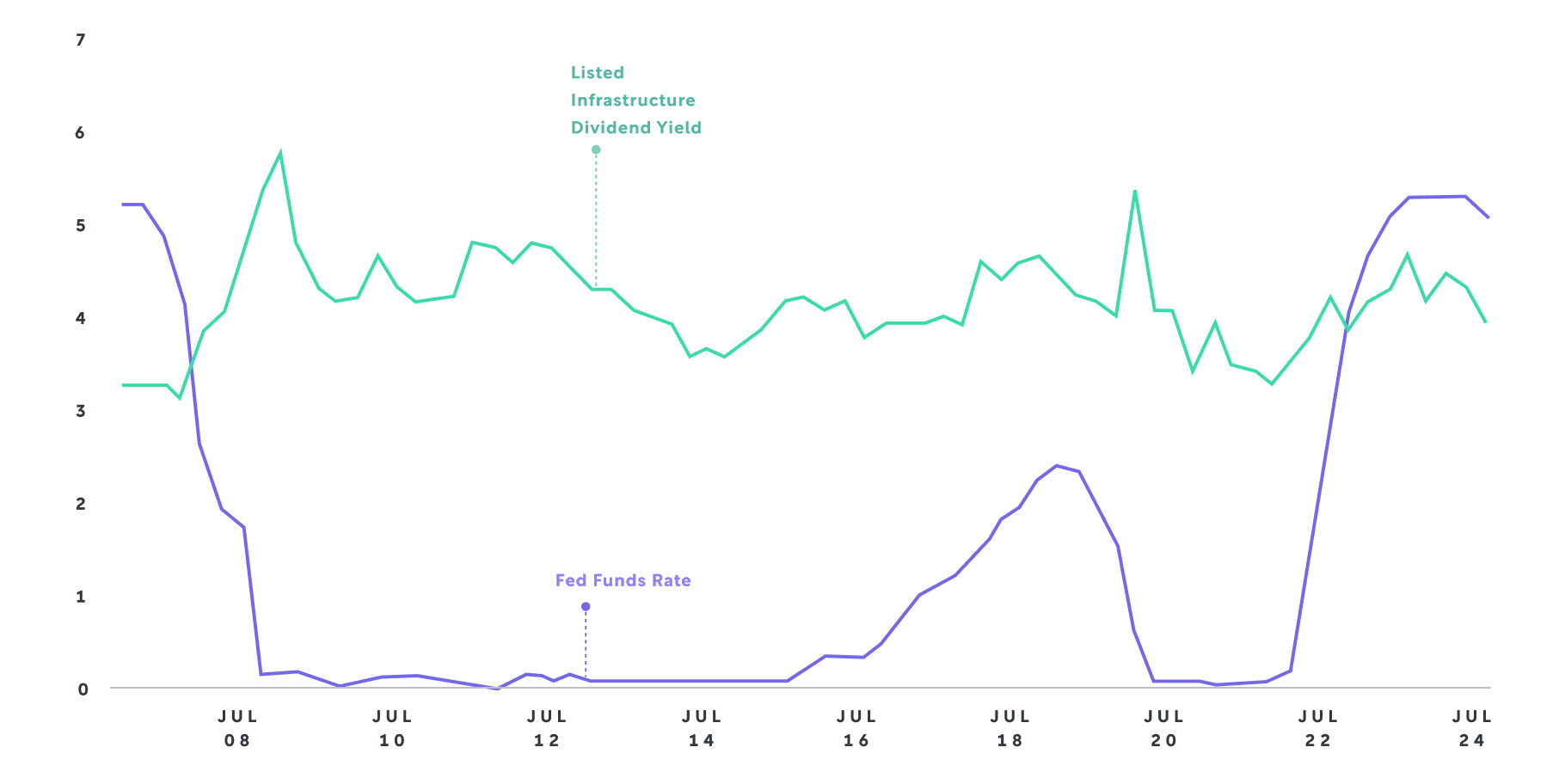

While public infrastructure REITs and ETFs can offer some inflation-adjusted income, their prices are often heavily influenced by broader stock market movements. Historically, higher inflationary periods have generally been linked with lower public market returns. Private infrastructure investments, by contrast, are typically tied more directly to real-world contracts and cash flows, and insulated from the public market swings noted above.

Note: Listed Infrastructure refers to the S&P Global Infrastructure Index. Source: Federal Reserve, Bloomberg, S&P Global. KKR, December 2024

Risk and reward of infrastructure investments

While the benefits of infrastructure investing are compelling, the quality, structure, and risk profile of funds can vary widely. Here are a few things to consider:

Stage of the underlying assets. Greenfield projects, which are brand-new developments, can offer higher return potential but also come with more construction, permitting, and operational risks. In contrast, core assets, which are infrastructure that are already operating, such as energy plants or fiber networks, tend to deliver more predictable cash flows with lower risk.

Geographic focus. Infrastructure investments in developed markets typically offer more stability and stronger legal protections, while emerging markets may offer higher growth potential but often carry greater economic, political, and regulatory uncertainty. While infrastructure is less exposed to tariffs and trade tensions than consumer goods, certain projects that depend heavily on imported materials or global supply chains could still face higher costs or delays, which makes fund manager selection very important.

Liquidity. Some funds are structured as evergreen, offering periodic opportunities for redemption, while others are closed-end vehicles that lock up capital for several years. Closed-end structures can better match the long-term nature of infrastructure assets but require more patience and a longer investment timeline. While private infrastructure funds are less liquid than public REITs or ETFs, that illiquidity can actually work in investors’ favor. Without daily pricing tied to market sentiment, valuations are based more on long-term contracts, steady usage, and real cash flows. This helps fund managers stay focused on fundamentals rather than short-term headlines.

How Arta does infrastructure differently

Private infrastructure shouldn’t be reserved for institutions with massive amounts of capital and exclusive access. We offer access to institutional-quality infrastructure funds, typically only available to large pension plans, endowments, and sovereign wealth funds, but we make it easier to participate by offering lower minimums, so investors don’t need millions to build a diversified portfolio.

Transparency is another core part of how Arta works. We provide clear, upfront pricing with no hidden fees, so you always know exactly where your money is going. We combine private markets expertise with an investor-first approach, helping you invest with confidence and clarity.

Who should consider private infrastructure

Private infrastructure could be a strong fit for accredited investors and qualified purchasers who want to diversify beyond stocks, REITs, or other private assets. If you’re looking to invest in essential assets that can deliver steady cash flows, long-term growth potential, and enhanced portfolio resilience, infrastructure could be a powerful addition to your financial strategy.

If you're ready to explore these products with confidence, Arta offers a modern platform to directly access private infrastructure designed for today’s investor.1 Sign up to get started today.

1 References to “today’s investor” reflect Arta’s intended audience of accredited investors and qualified purchasers, and do not imply suitability for any specific individual.

Do you want in?

Create an account in an instant

Sharing is caring

Disclosures

We believe the information presented to be accurate as of the date published and such information may not be updated in the future.

The information contained in this communication is provided for general informational purposes only, and should not be construed as investment or tax advice. Nothing in this communication should be construed as a solicitation, offer, or recommendation, to buy or sell any security.

Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Arta Finance or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Copyright Arta Finance 2026. All rights reserved.

Get the latest market trends and investment insights