In this timely market update, Emmy Sakulrompochai, Arta’s Head of Investment Advisory, breaks down the forces behind the market sell-off, what’s next, and how investors can position their portfolios in today’s shifting landscape.

What happened to the market?

Markets have experienced a sharp sell-off, with the S&P 500 officially entering a 10% correction for the first time in two years. As of March 19th, the index closed at 5,675, down -3.5% year-to-date. While macroeconomic data has been generally constructive—inflation is easing, and the labor market remains resilient—investor sentiment has been weighed down by rising trade tensions, geopolitical uncertainty, and reassessments of equity valuations.1

The sell-off has been broad-based, but high-growth sectors, particularly technology, have been hit the hardest, leading to a major rotation into defensive sectors such as healthcare, utilities, and consumer staples. Meanwhile, safe-haven assets have surged, with gold surpassing $3,000 for the first time.1

The year began with expectations of U.S. exceptionalism, fueled by deregulation, tax cuts, and AI breakthroughs, while tariffs were initially seen as a negotiation tool rather than the start of a prolonged trade conflict. However, the shift in narrative—from tactical trade measures to a full-scale trade war—has unsettled investors, increasing anxiety and market volatility as they reassess risks in an already fragile economic environment.

What’s keeping markets on edge?

The recent correction is driven by a combination of factors, including rising trade tensions, high equity valuations, and concerns over economic growth.

Escalating trade war risks: President Trump’s latest proposed tariffs—some as high as 200%—along with broad existing tariffs and new reciprocal trade measures set to take effect on April 2, have escalated tensions with multiple trade partners. Markets reacted negatively to rising policy uncertainty and inflation risks, which could weaken consumer spending and investor confidence, potentially impacting corporate earnings, hiring, and capital expenditures.2

Slowing economic growth: While February’s core CPI increased by just 0.23% month-over-month, providing temporary relief for consumers, broader economic indicators suggest that inflationary pressures remain persistent. Initial jobless claims remain low at 220,000, signaling continued labor market strength, but concerns over trade-related disruptions have led major banks to revise U.S. growth forecasts downward – in the case of Goldman Sachs, from 2.4% to 1.7%.3

High valuation increases market sensitivity: At the start of the year, the S&P 500 traded at a P/E ratio of 22.5x, among its highest levels in two decades (excluding COVID distortions), making the market more vulnerable to shifts in sentiment and economic uncertainty. With valuations stretched, even modest risks—such as policy shifts or economic data surprises—can trigger outsized reactions. The recent 10% market correction has brought valuations closer to historical norms, reflecting a repricing of risk and uncertainty as investors adjust their expectations in response to evolving economic and policy conditions.1

Signs of strength amid uncertainty

Economic and corporate fundamentals remain strong: Despite market volatility, the U.S. economy and corporate profits remain on solid footing. Consumer spending is steady, the labor market remains resilient, and corporate earnings continue to hold up despite external pressures. While tariffs introduce risks, some economic growth concerns may be exaggerated, as the broader economic data does not yet indicate a major downturn. Additionally, if conditions weaken further, the Federal Reserve has tools to stabilize markets through rate adjustments or liquidity support.

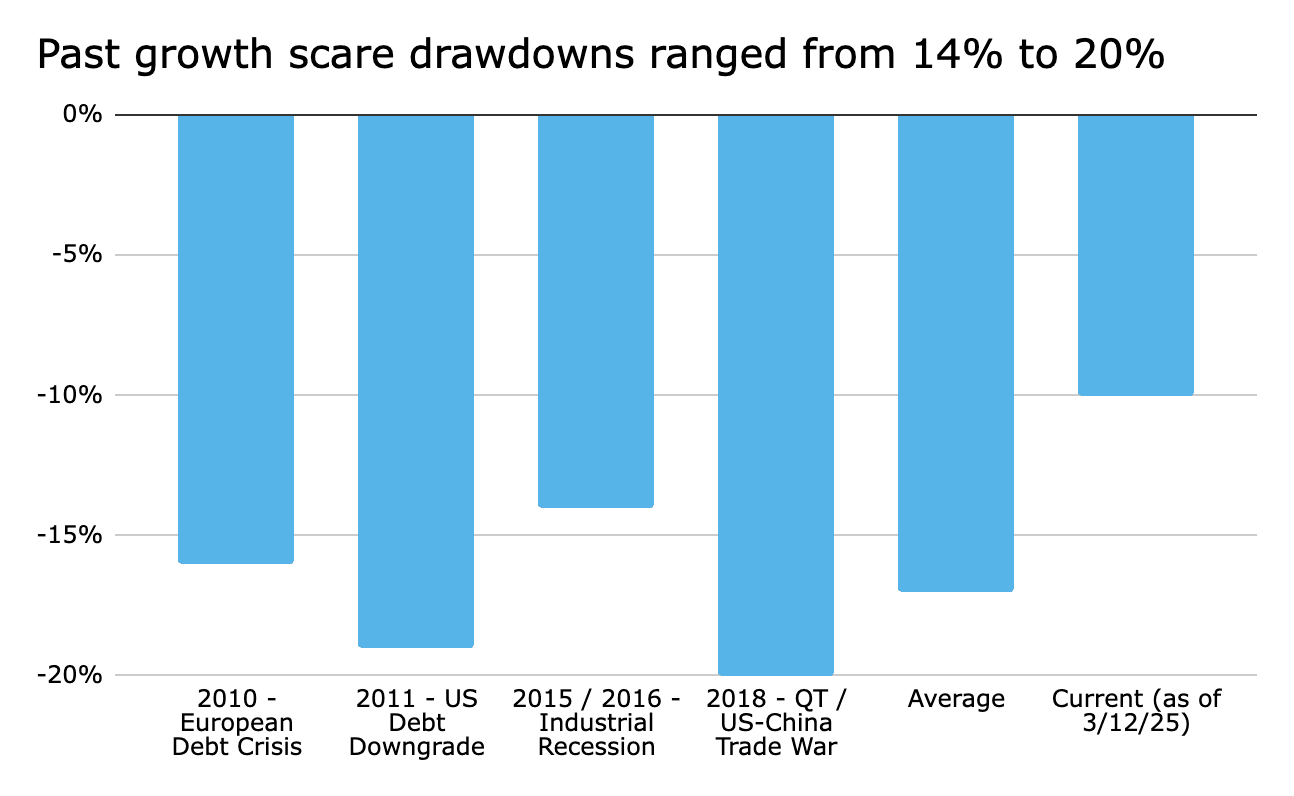

Market pullbacks are a normal part of investing: Market corrections of 10% or more are a regular occurrence, happening in most years as part of normal market cycle. Over the past 15 years, there have been four instances of economic uncertainty that did not lead to a recession, and current conditions suggest this downturn is following a similar pattern. Valuations have now adjusted closer to historical norms, reducing speculative excess and improving the market’s long-term risk-reward balance. Historically, pullbacks like this have often created opportunities for long-term investors, rather than signaling prolonged economic distress.4

Source: Royal Bank of Canada and JPMorgan. As of 3/12/2025. S&P 500 performance with major growth scare deadlines - magnitude of pullback (%).

How to navigate this market?

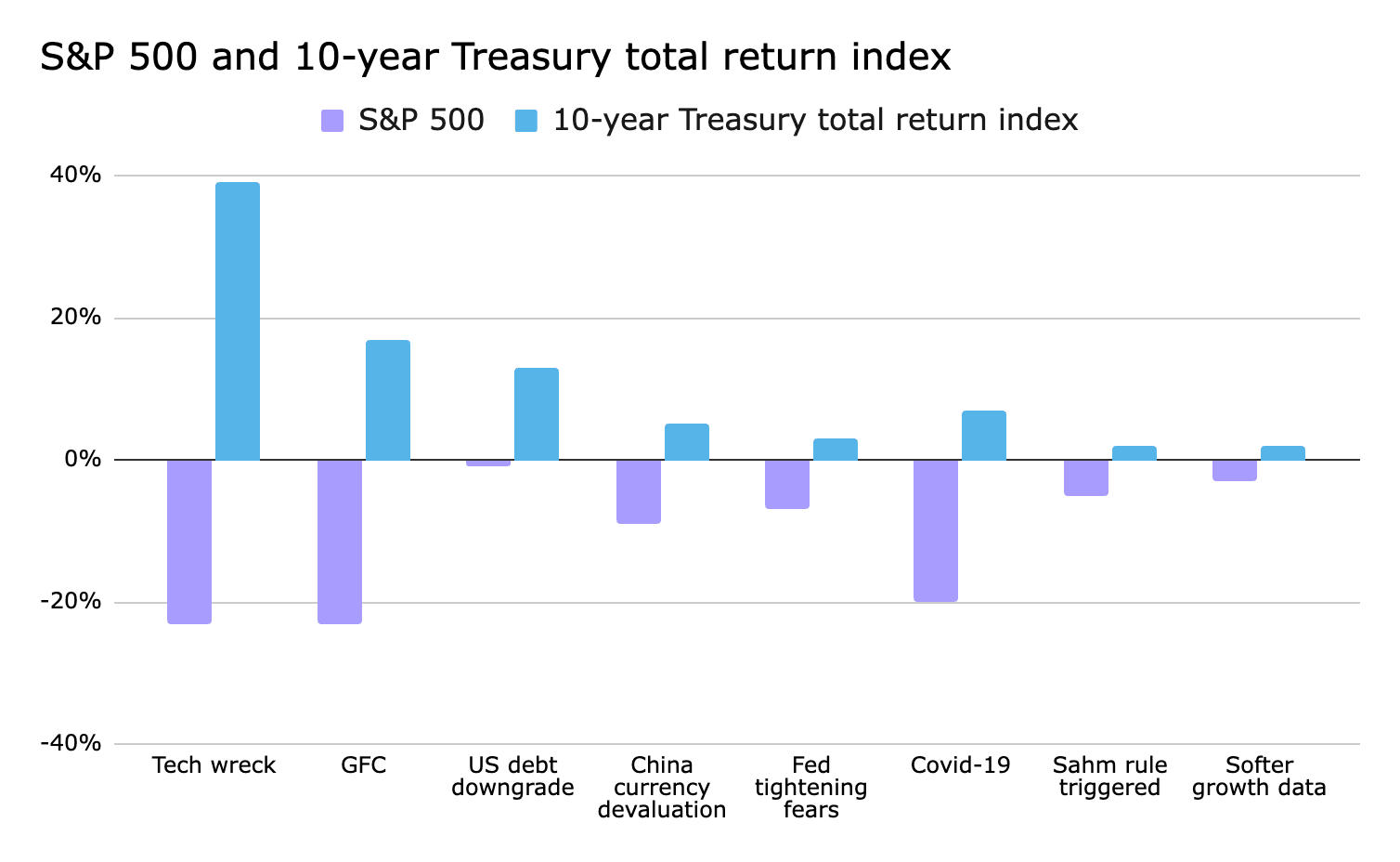

Cross asset class diversification: As I highlighted during Arta’s market outlook webinar last month, diversification remains a key theme in navigating market uncertainty, helping cushion portfolios against external shocks. Spreading investments across equities, fixed income, and alternative assets can enhance resilience by balancing risk and return. This approach has proven effective so far this year—despite declines in U.S. equities, a 60/40 portfolio is down less than 2%. To strengthen portfolios beyond equities, private credit and infrastructure investments offer stable cash flows, income generation, and low correlation to stocks, while gold has outperformed year-to-date, driven by central bank demand and heightened uncertainty.4

Source: Bloomberg L.P. Data, JP Morgan. Data as of February 26, 2025. 10-year represented using the Bloomberg U.S. Government 10 Year Term Total Return Index. Tech wreck measures Jun '00 to Dec '03, GFC measures Sep '07 to Dec '09, U.S. debt downgrade measures Dec '10 to Nov '11, China currency devaluation measures Jun '15 to Feb '16, Fed tightening fears measures Sep '18 to Jan '19, Covid-19 measures Jan '20 to Mar '20, Sahm rule triggered measures 2-4 Aug '24, softer growth data measures 18-26 Feb '25.

Consider fixed income: With rising economic uncertainty, fixed income is once again proving its value as a diversification tool. The 10-year U.S. Treasury yield has declined for seven consecutive weeks, its longest streak since 2019, reflecting increased demand for defensive assets. This week as of March 19th, the 10-year yield stands at 4.25%, while the 2-year yield is at 3.98%.1 Fixed income acts as a buffer against growth shocks. With rates stabilizing, bonds continue to play a crucial role in mitigating downside risk and preserving capital in volatile markets.5

Diversify geographically: With deglobalization and shifting economic policies, geographical diversification is increasingly important in managing market-specific risks. European markets have outperformed U.S. equities this year, supported by fiscal stimulus, increased defense spending, and ECB rate cuts. Optimism around a potential resolution to the Ukraine war, valuation catch-up, and stronger earnings has further boosted sentiment. Meanwhile, China has rallied, driven by AI advancements, renewed investor confidence, and policy support. With both Europe and China showing resilience, this underscores the importance of diversifying beyond U.S. markets to capture global growth opportunities while mitigating concentrated risks.

Short term vs. long term portfolio: Understanding which portion of your portfolio is for the short term and which is for the long term is essential for managing risk and staying disciplined during market volatility. This reinforces the importance of a core and satellite portfolio construction framework. If you haven’t already, consider dividing your portfolio into long-term and short-term buckets. For long-term investments, stick to a strategic asset allocation (SAA) aligned with your financial goals and only adjust when your portfolio significantly deviates from its target or when your circumstances change. Short-term investments, on the other hand, are more tactical, allowing for active adjustments based on market conditions. This bucket is more prone to emotional decision-making, making it essential to stay disciplined. Structuring your portfolio this way allows you to navigate market uncertainty more effectively and manage risk with greater confidence.

1. Source: Bloomberg 2. Source: Bloomberg, https://www.bloomberg.com/news/articles/2025-03-19/trump-s-200-alcohol-tariff-threat-shocks-european-drink-firms 3. Source: Goldman Sachs, Eblock Media, https://www.eblockmedia.com/news/articleView.html?idxno=14619 4. Source: JP Morgan Private Bank, https://privatebank.jpmorgan.com/nam/en/insights/markets-and-investing/tmt/tariff-implications-for-investors-building-a-resilient-portfolio-amid-pullbacks 5. Source: JP Morgan Private Bank, https://privatebank.jpmorgan.com/nam/en/insights/markets-and-investing/tmt/navigating-rate-risks-how-bonds-are-better-positioned-in-2025

Do you want in?

Create an account in an instant

Sharing is caring

Disclosures

We believe the information presented to be accurate as of the date published and such information may not be updated in the future.

The information contained in this communication is provided for general informational purposes only, and should not be construed as investment or tax advice. Nothing in this communication should be construed as a solicitation, offer, or recommendation, to buy or sell any security.

Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Arta Finance or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Copyright Arta Finance 2026. All rights reserved.

Get the latest market trends and investment insights