Arta gets you access to financial opportunities that help you to plan and enjoy your financial future like the ultra-wealthy do – but with less complexity and lower fees.

We call this your digital family office.

Let’s take a look at 3 family office services Arta eanbles, in order to help you level up your financial strategies.

Line of Credit

Let’s start with a trick super-wealthy folks use: a Line of Credit.

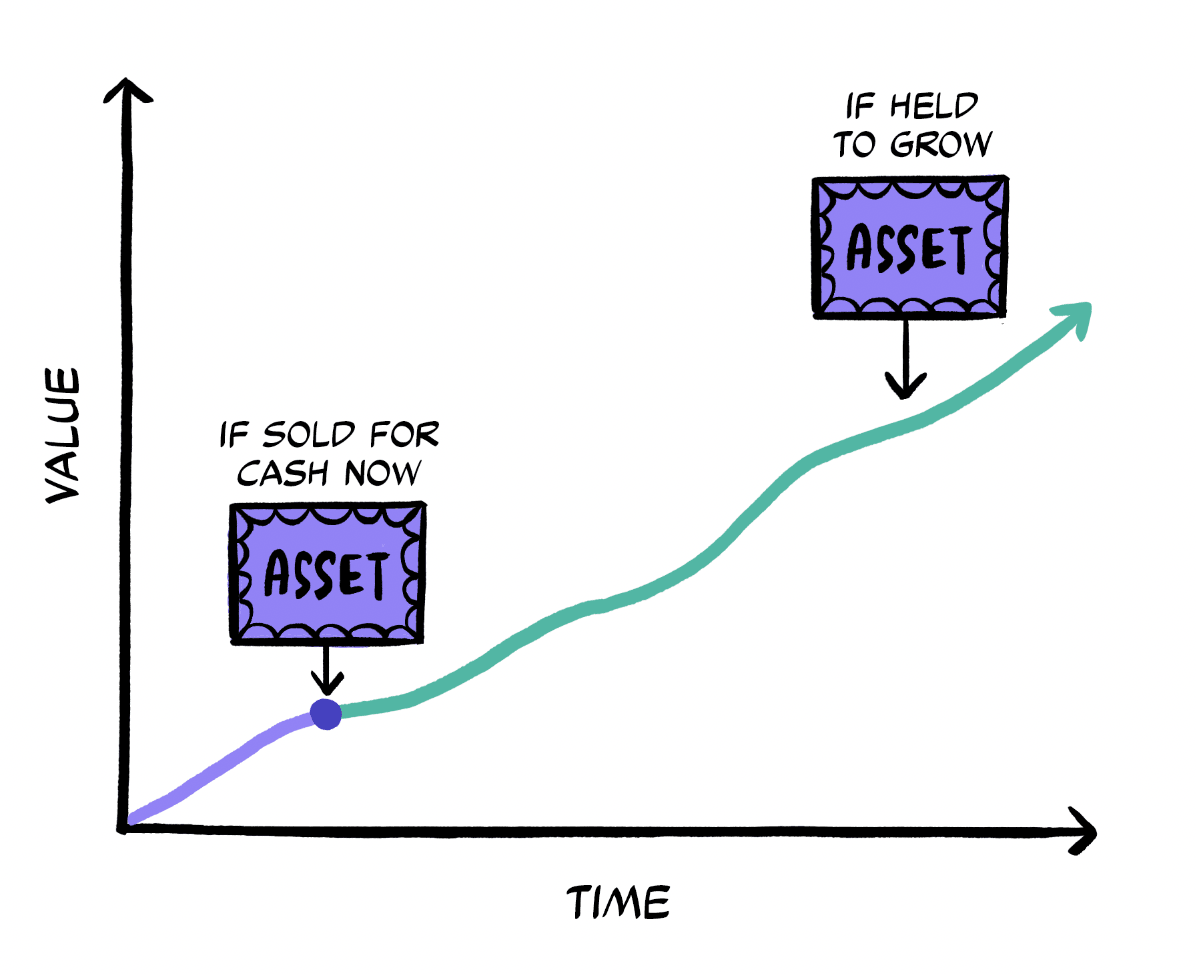

When ultra-rich folks need cash fast — like to buy a house or make a large tax payment — what they don’t do is sell their assets.

They borrow it from their Line of Credit!

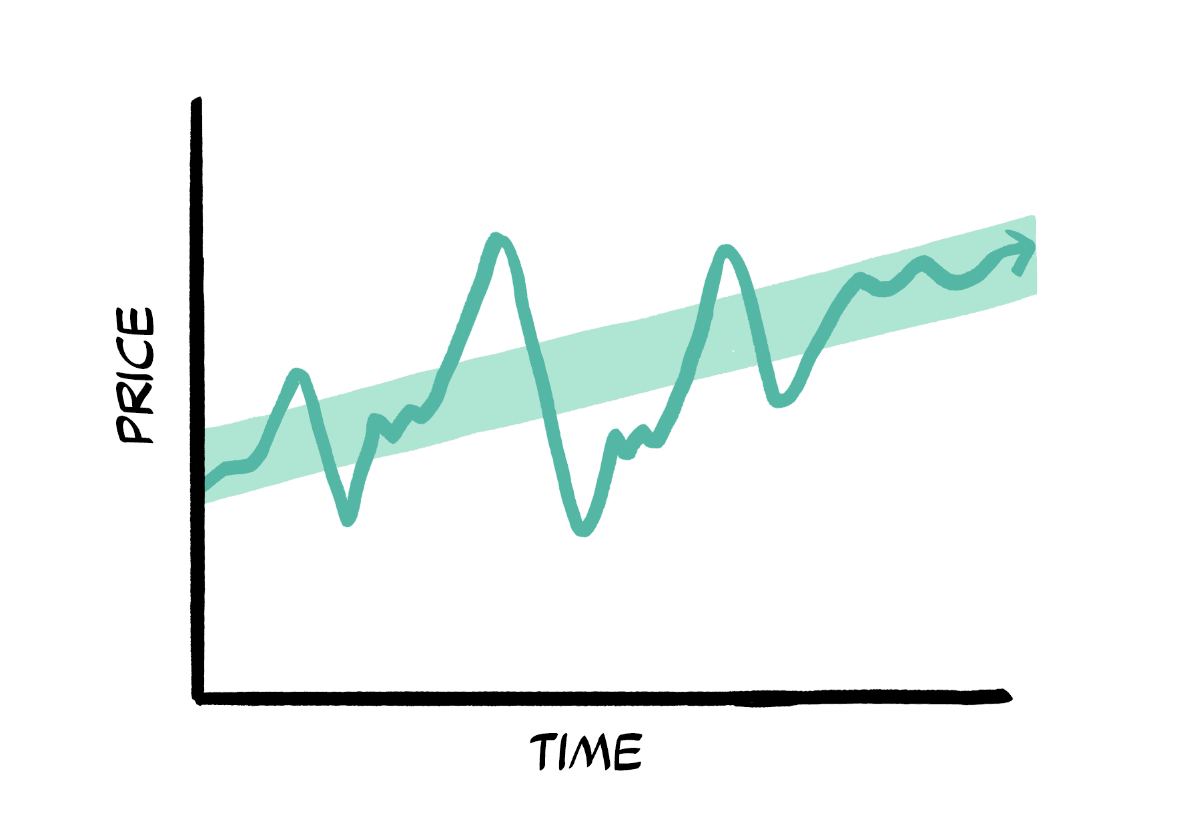

So their assets can continue to grow!

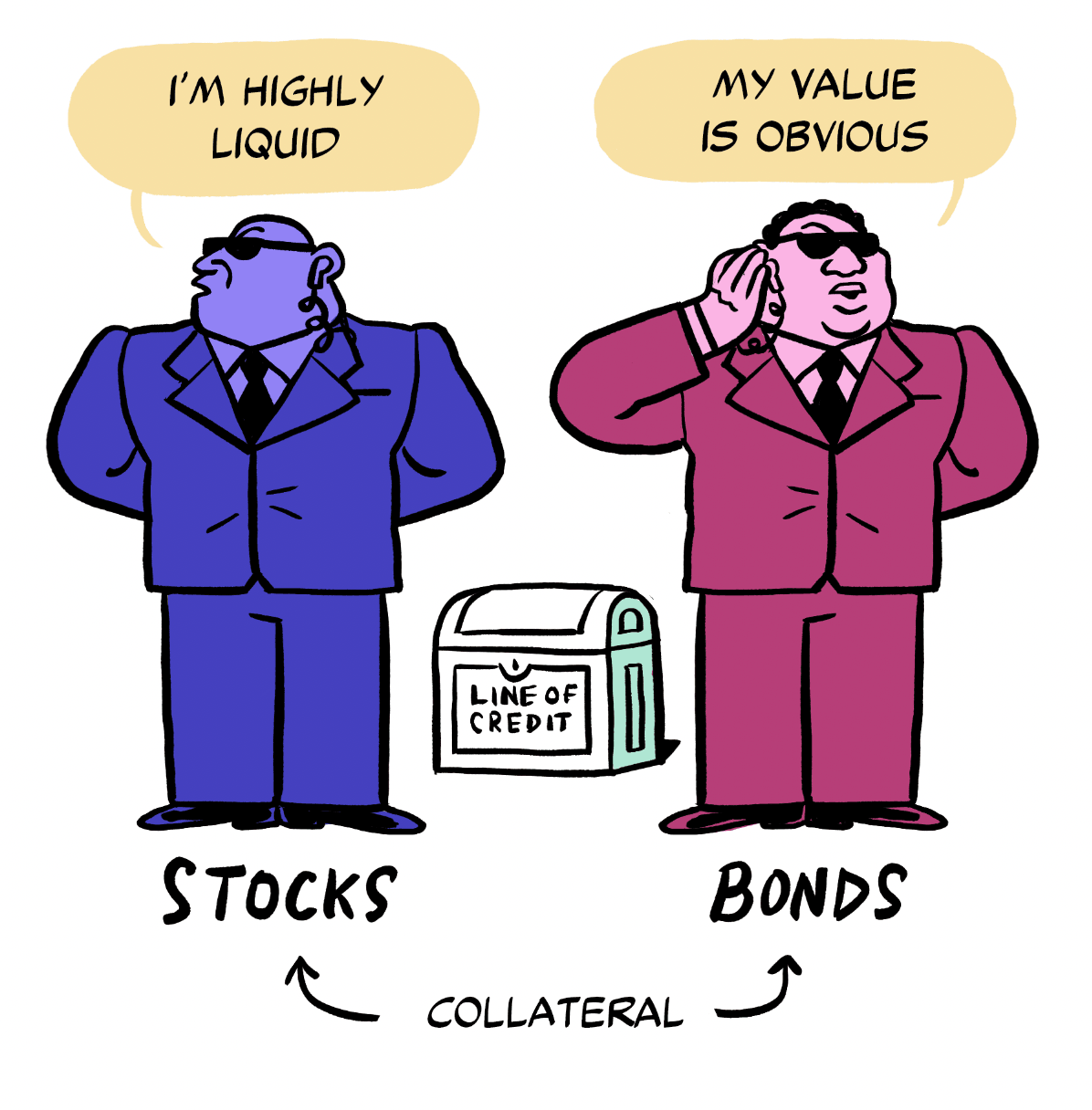

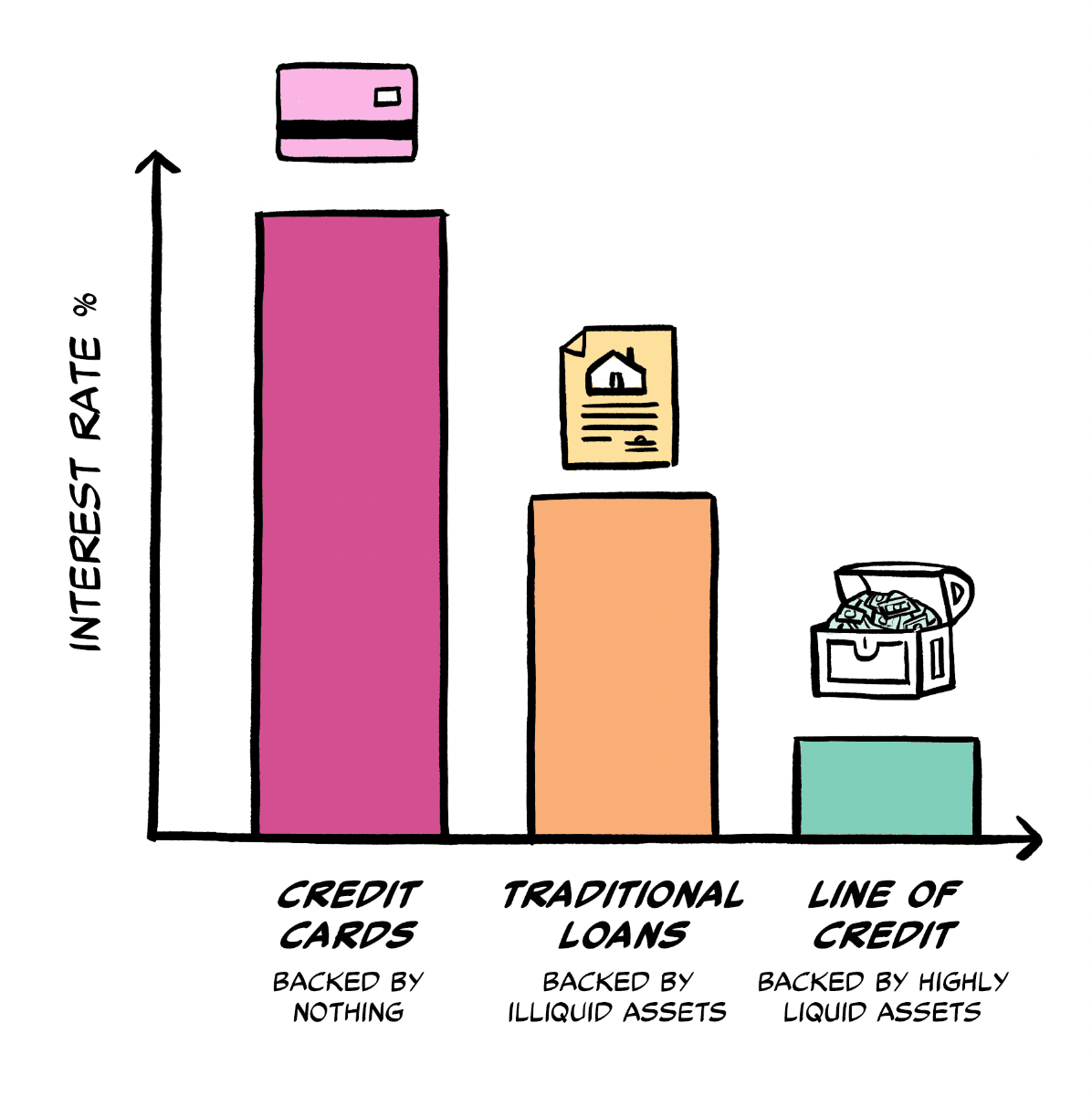

Arta can help you with a Line of Credit, secured by the public stocks and bonds in your portfolio.

Because this type of collateral is so liquid, you get very low interest rates on the money you borrow!

Arta enables you to pay it back as fast or as slow as you like! Plus, Arta charges no fees!

If you decide that it's right for you, you can open your line of credit for free so you have it handy in case you want it. You won't pay interest unless you use it.

A Line of Credit is a great example of a financial superpower Arta can grant you based off of the stock you already have. Another way to level up is by using Options.

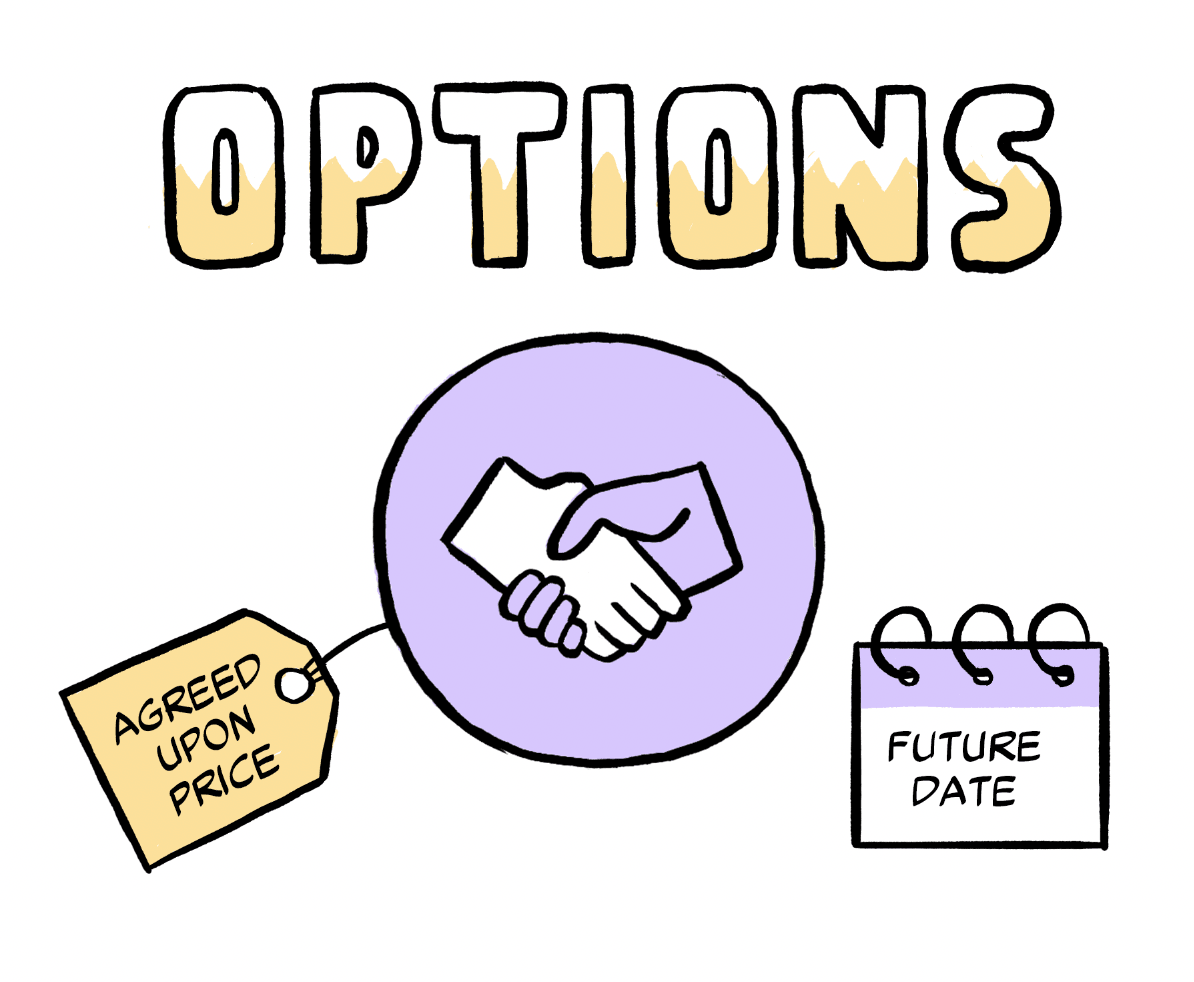

Options

Options are agreements for the right to buy or sell stock at a certain price at a certain time.

You can sell someone the right to be first in line to buy your stock at the agreed price, if they choose. That choice — or call option — has value! Which they pay you for.

Arta uses options to level up your financial sophistication in two powerful ways. The first is called Income Stream Options.

Income Stream Options

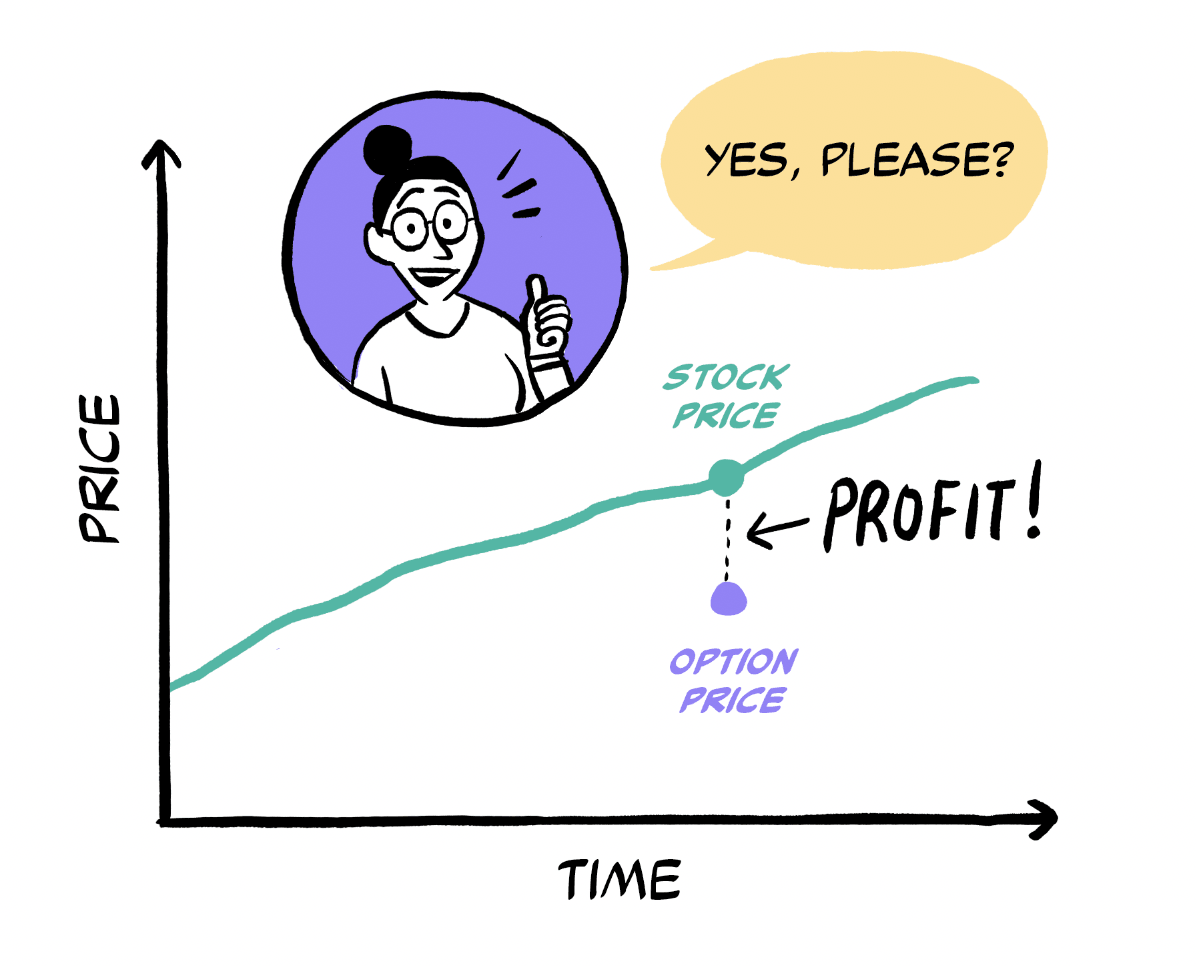

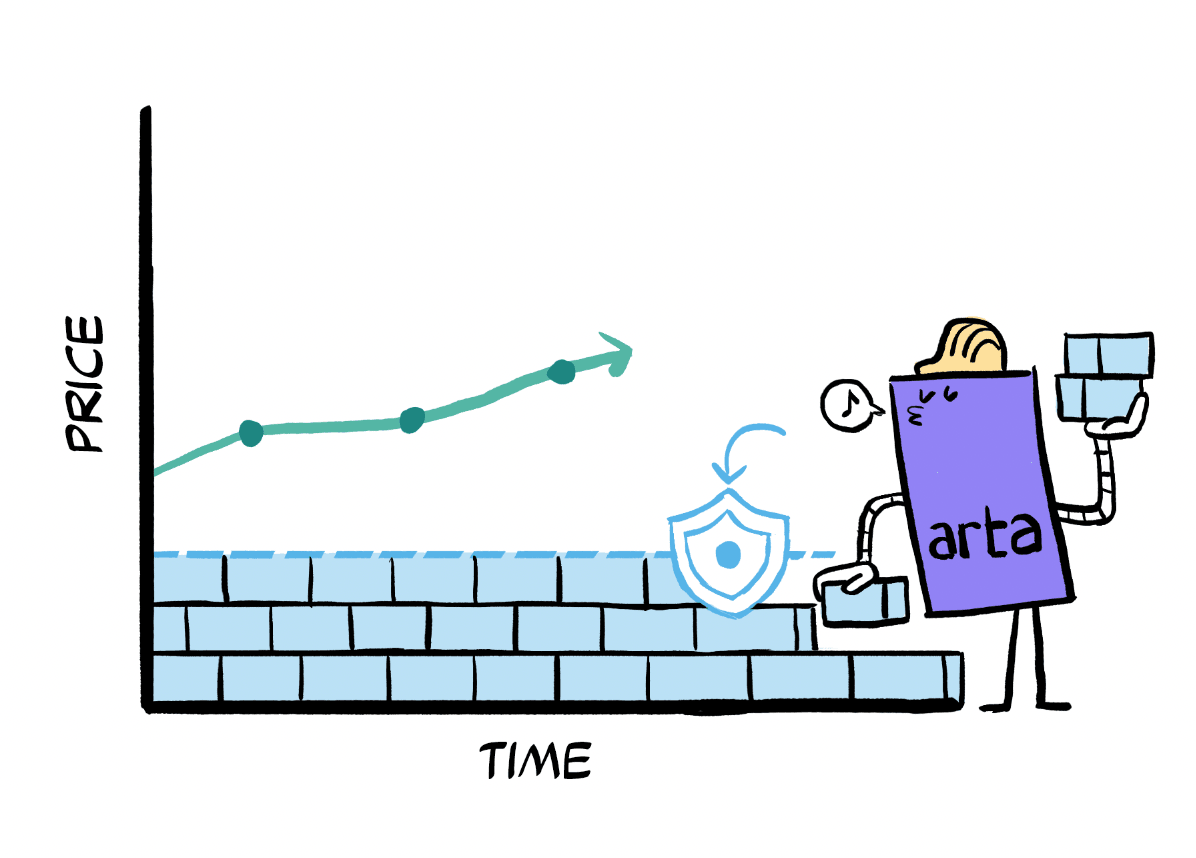

Income Stream Options create an income stream from your stocks while you seek to sell them at a higher price.

Say you have a stock you want to sell — like if you’ve acquired a lot of stock as compensation from your company — but you want to sell it at a certain higher price.

You might want to do this because you need to diversify out of this stock. Income Stream Options will help you be systematic and disciplined about this.

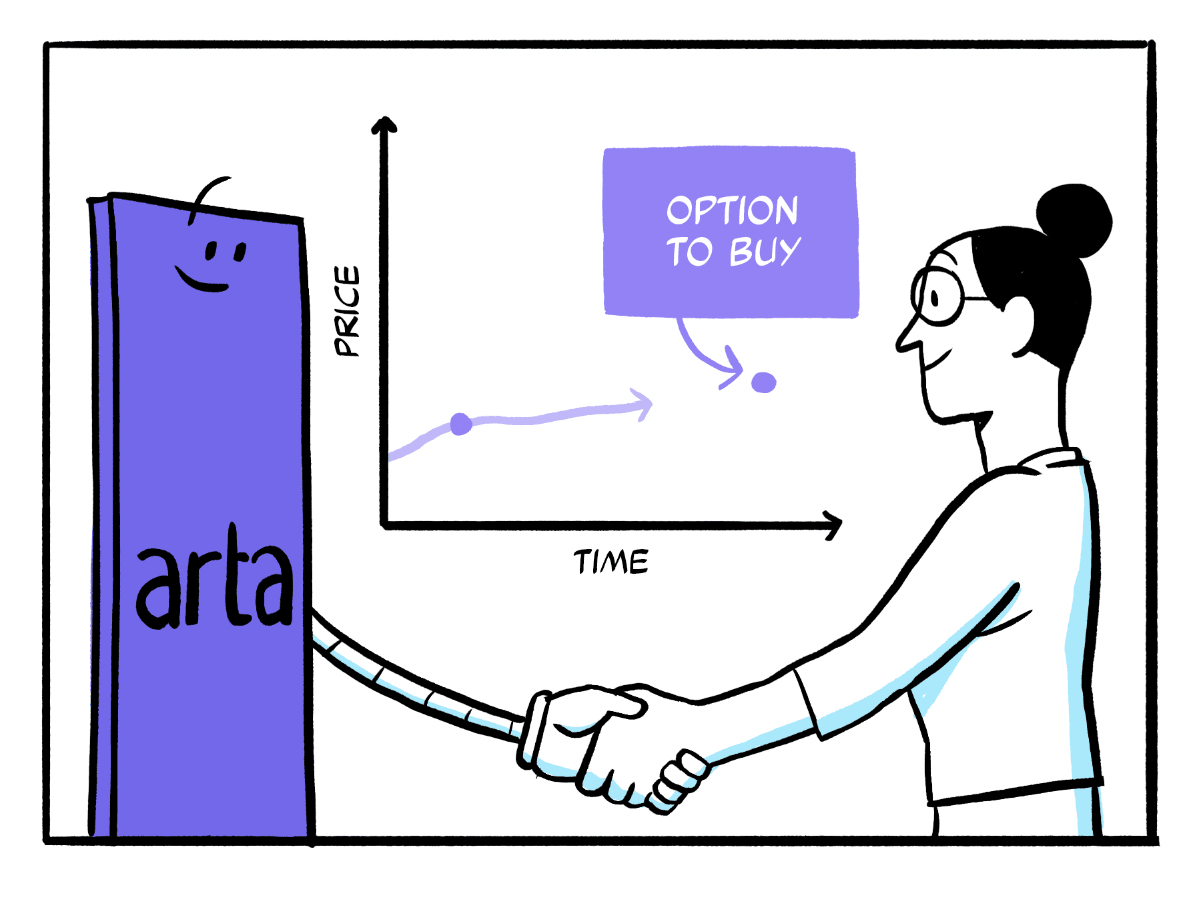

You can tell Arta that price, and it will sell an option to someone to buy it at or above that certain price in the future.

You earn a little cash from selling the option.

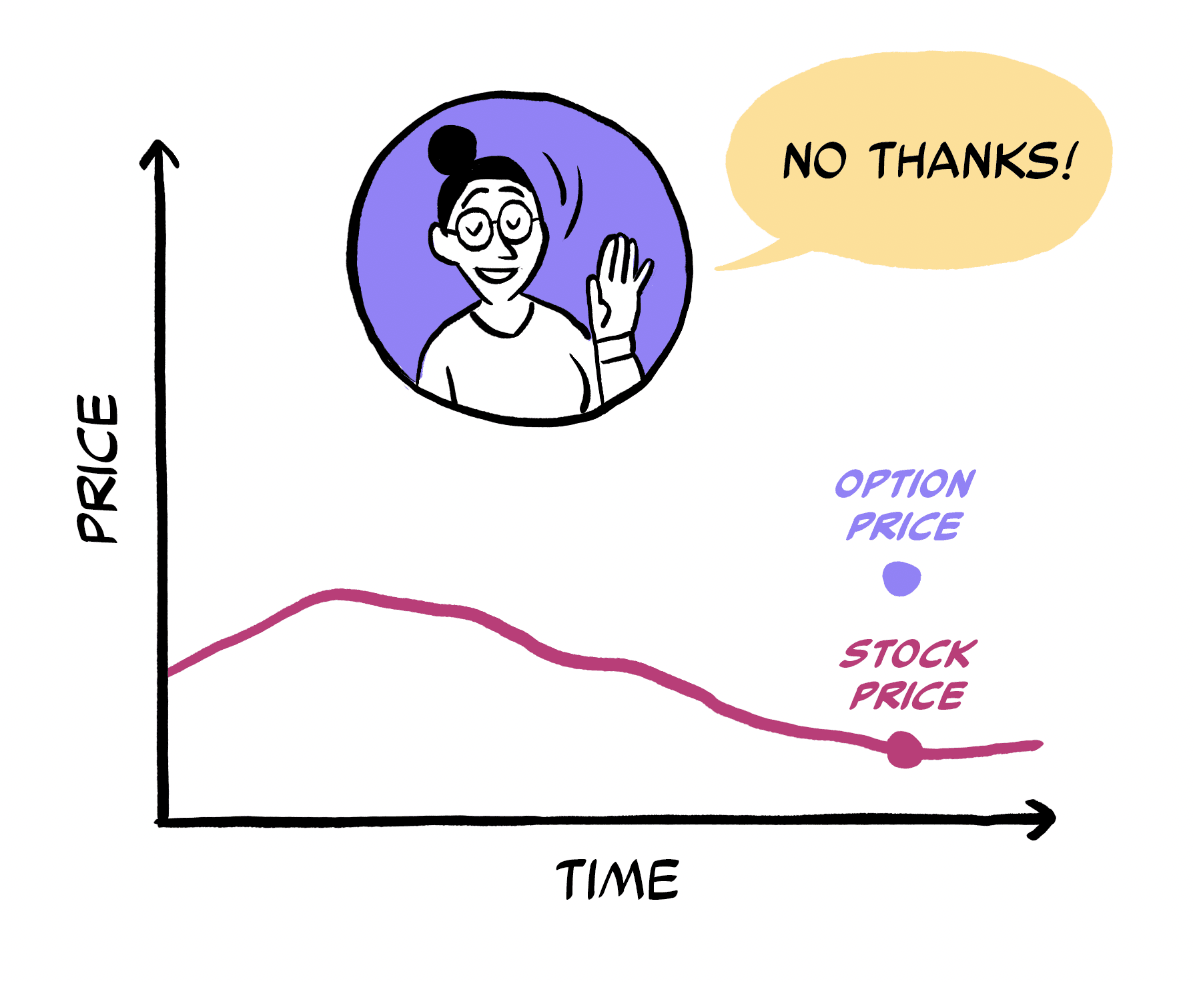

If the stock doesn’t rise to the agreed upon price, the person who bought the option will let it expire.

You keep your stock, but earn a little cash from selling someone the option.

If the stock goes above the agreed upon price, they will probably buy it — because they’ll be getting it below market price and will earn a little profit.

In this scenario, you sell your stock at the higher price you wanted, plus you earned cash from selling someone the option.

In both scenarios you make money!

Basically, you trade giving away a little potential upside for a guaranteed cash income stream. But this works out for you, because you were willing to sell that stock anyway.

Ultra-rich folks do a lot of this — but it’s a lot of work, so they pay professionals to do it for them. Arta’s tech can do it easily, so you get it for free!

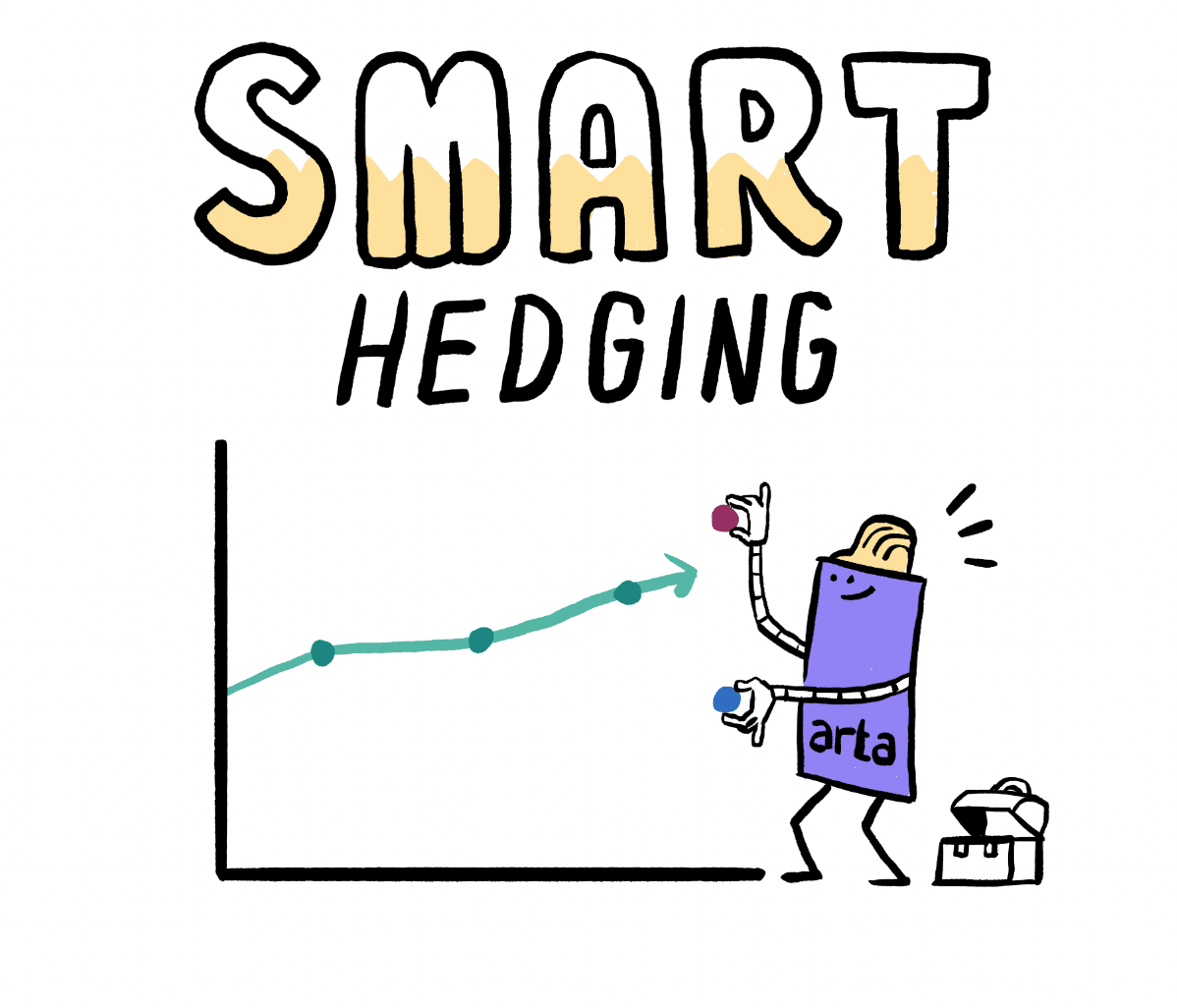

Smart Hedging Options

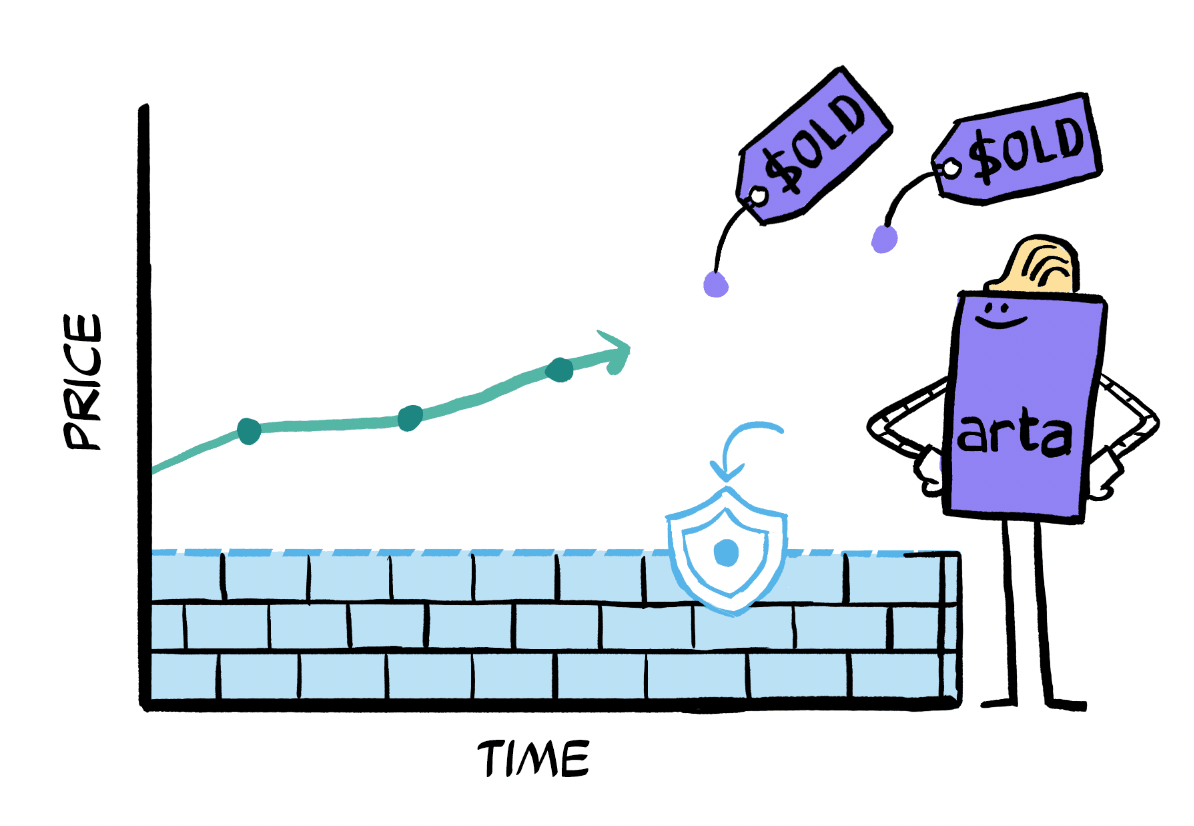

Another way Arta levels you up with options is by Smart Hedging.

It gives you downside protection for free!

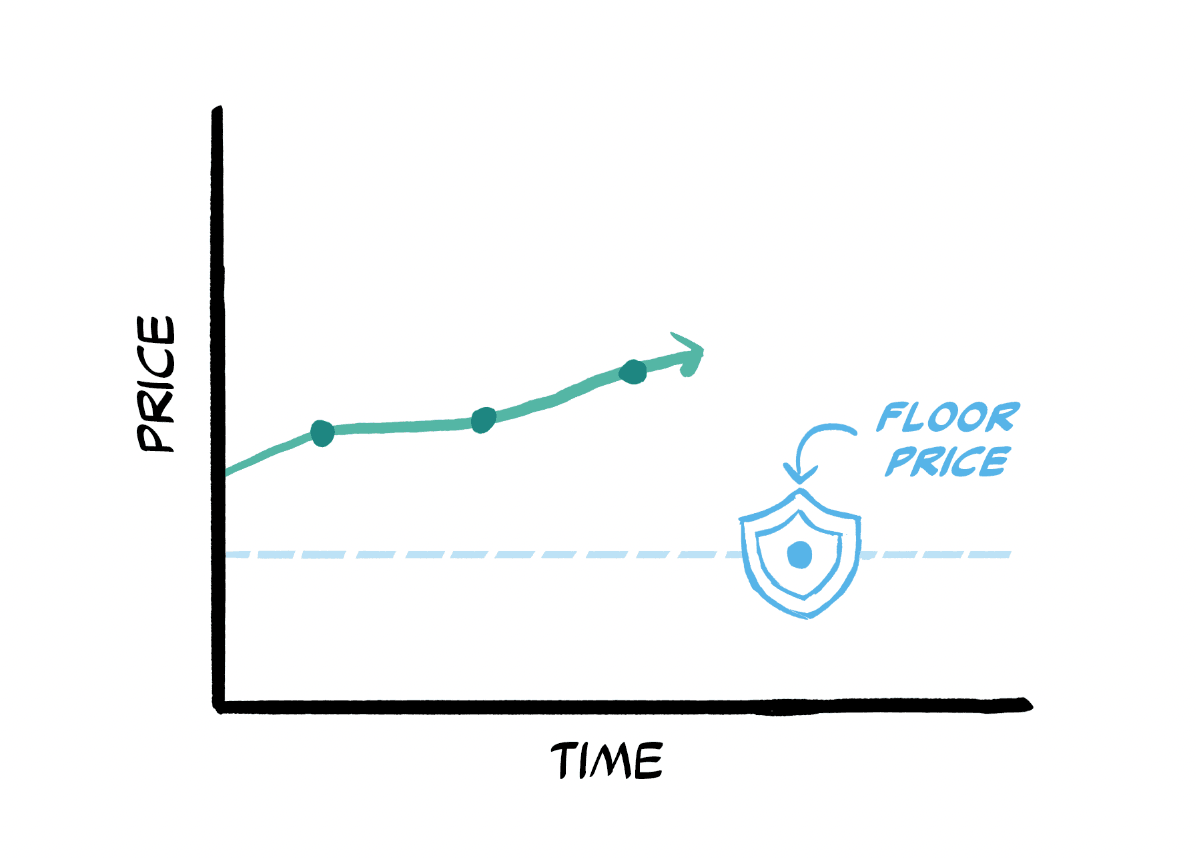

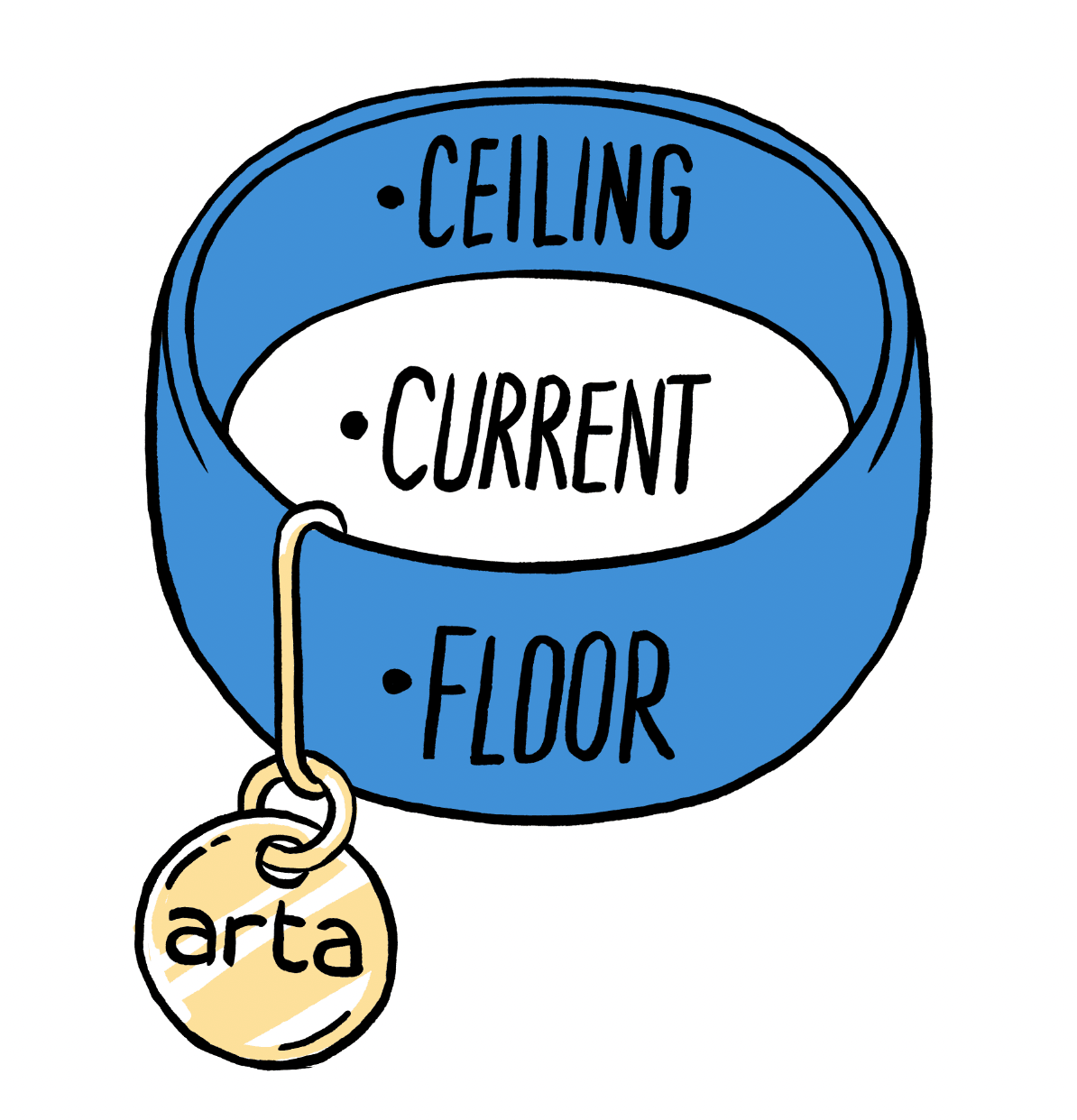

Pick a stock you’re ok selling, and a price you’re willing to sell it at to protect against losses that you don’t want.

For example, if one stock represents a large portion of your portfolio, you could face a lot of harm if the stock falls below a certain price.

All you need to do is choose that floor price.

Arta will buy options at that price, so you’re guaranteed to never lose more than that.

Arta will then sell options at a higher price, and use that cash to pay for the lower priced floor options.

So that means if the stock rises to the higher price, those stocks will be sold – which is great, because you were okay with selling them anyway!

Smart Hedging works for you if you want to lock-in financial stability — like if you’re going through a major life change, switching jobs, buying property or having children.

It’s a pretty sophisticated strategy, in the biz we call it a “zero premium collar option strategy”.

Ultra-rich folks pay pros to do it for them, but Arta levels you up for free!

Last, but not least, the ultra-rich even use insurance to grow their wealth.

Sam, can you enlighten us?

Insurance

Of course! While you’ve probably heard about the common types of insurance:

There is a type of insurance you probably don’t know about, but the super-wealthy love to use to generate tax-advantaged wealth.

In the biz it has all kinds of complicated names, like variable universal permanent life insurance, but at Arta we bring you all the benefits in a much simpler package that we call WealthGen Insurance.

Wealth Gen Insurance

Unlike common term life insurance, it never expires — as long as you pay the premiums — and it has a tax-advantaged investment account bolted onto it. It’s basically a ROTH IRA with life insurance – without the limits and restrictions of a ROTH IRA.

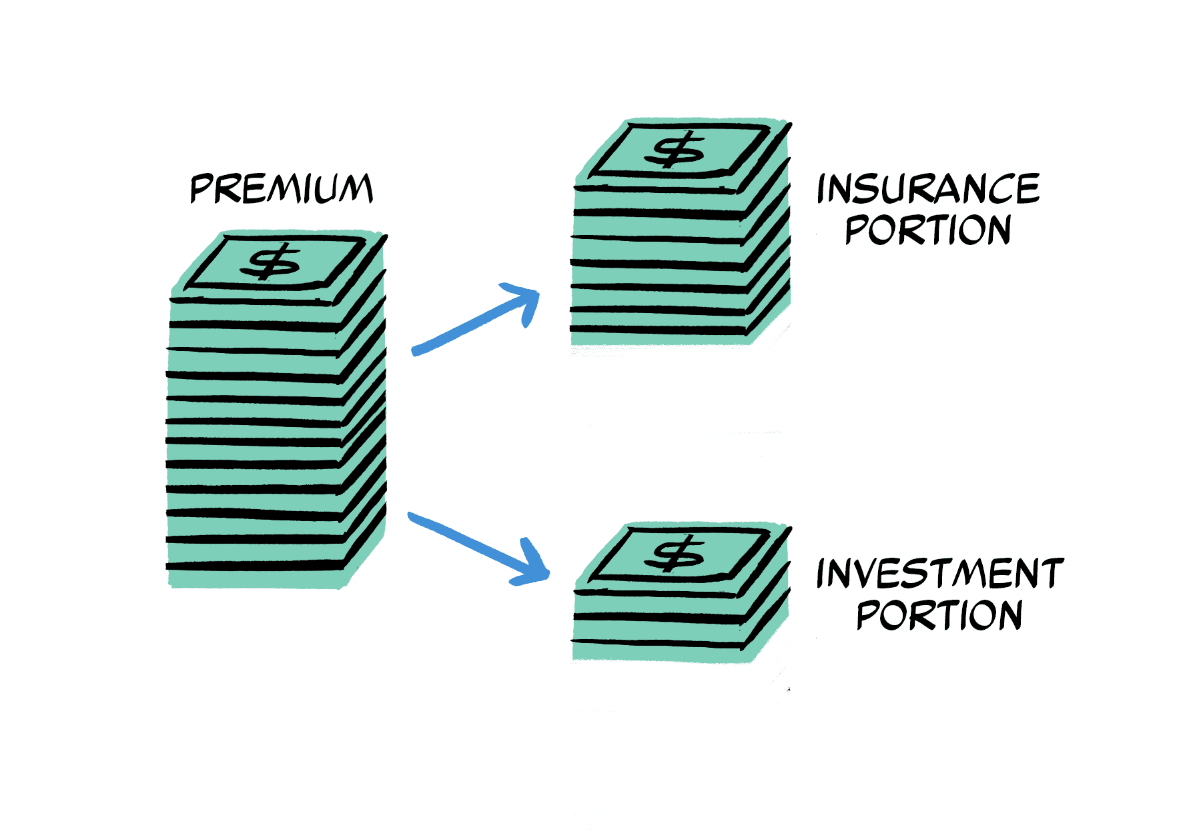

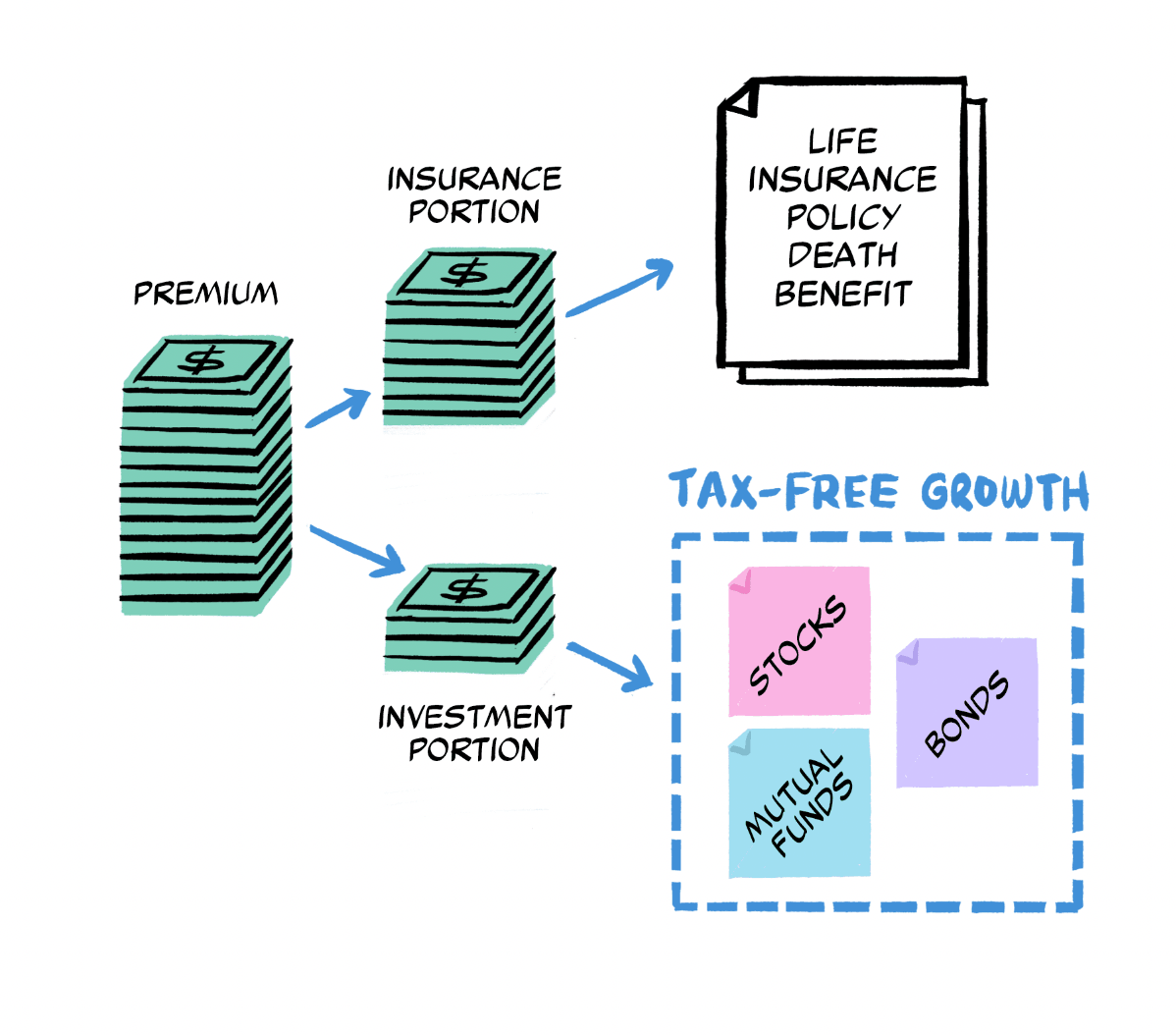

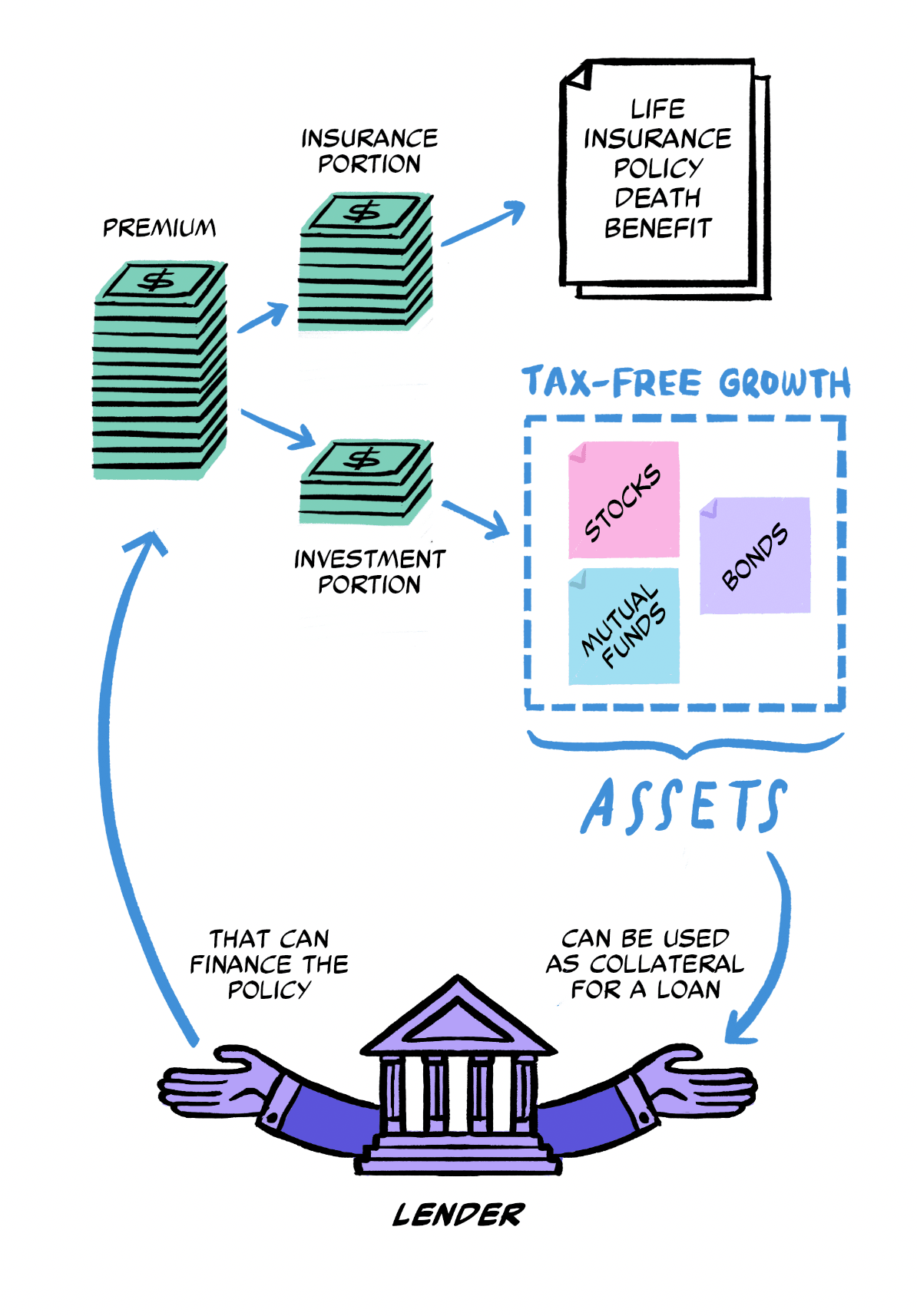

You make regular payments, called premiums, but they are divided into an insurance portion and an investment portion.

With the investment portion, you can invest in lots of assets: stocks, bonds, mutual funds and the like. For qualified investors, it can even invest in private placements like private equity or private credit. And it grows tax free!

Although early withdrawals will be taxed, you can access this money when you're alive via a tax free policy loan. Or when it becomes inheritance for your family, this is income tax free for them too.

And, because it holds assets, you can borrow money to pay the premiums - just like you use a mortgage to buy a house.

Anyway, I could go on and on, but that’s another level-up used by the super-wealthy that Arta gets you access to.

OK! That’s a quick overview of how Arta levels up your financial powers, you can learn more in the Arta app here.

See you next time!

Do you want in?

Create an account in an instant

Sharing is caring

Disclosures

We believe the information presented to be accurate as of the date published and such information may not be updated in the future.

The information contained in this communication is provided for general informational purposes only, and should not be construed as investment or tax advice. Nothing in this communication should be construed as a solicitation, offer, or recommendation, to buy or sell any security.

Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Arta Finance or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Copyright Arta Finance 2026. All rights reserved.

Get the latest market trends and investment insights