Have you ever visualized the impact of taxes on when you actually start earning for yourself each year?

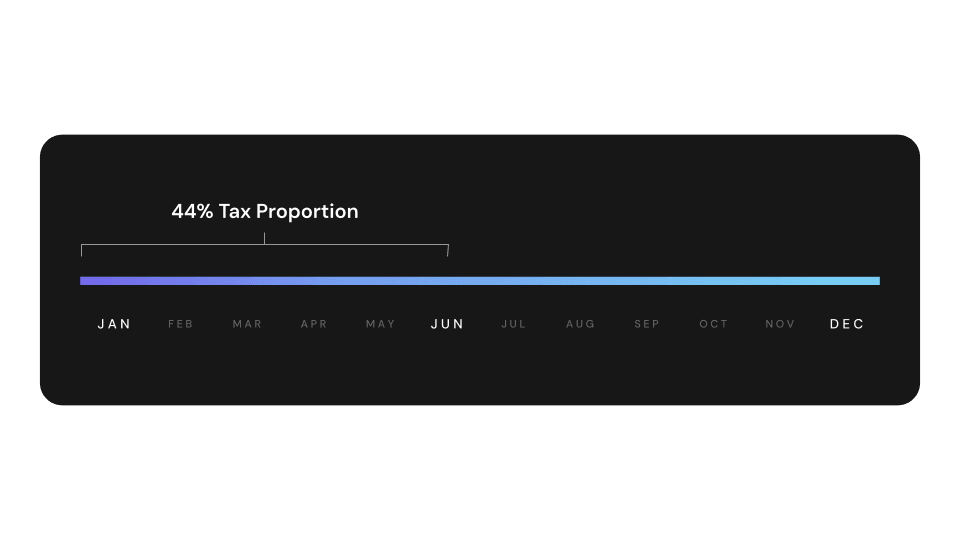

Picture this: you're a tech professional in California, where your $250,000 salary places you in one of the highest tax brackets. With combined federal and state tax rates hovering around 44%, nearly half of your hard-earned income is allocated to taxes. This chunk of your income could be seen as the price you pay for being part of one of the world's most vibrant economic hubs.

Let’s look at it another way. If we translate that 44% into the calendar year, it paints a stark picture: it’s as if you don't start earning for yourself until early June. Imagine that—nearly half the year goes by before your earnings actually start to accumulate in your pocket. We refer to this point as your "Done with Taxes Day," the day you effectively start earning for yourself after all tax obligations have been met.

Source: Arta Finance

So the question becomes, how can we actively work towards bringing this date forward, enhancing your financial liberty? One effective strategy to achieve this is through tax-loss harvesting on direct indexing. This approach allows you to manage your investments more actively, turning potential investment losses into opportunities to reduce your taxable income.

Here’s how it works:

Tax-loss harvesting involves selling securities that have experienced a loss and replacing them with similar ones, maintaining the optimal asset allocation. Capturing these losses over time can offset gains in the future.

Direct indexing lets you own the underlying stocks of an index directly, providing opportunities for tax-loss harvesting that you wouldn’t have with traditional mutual funds or ETFs.

By integrating these strategies, you can offset capital gains and potentially reduce your taxable income. This dual benefit accelerates when you reach Done with Taxes Day each year, possibly moving it from June to an earlier date.

Want to explore the possibility of an earlier Done with Taxes Day? Arta provides products for tax-loss harvesting and direct indexing, along with resources to help determine if they're right for you. Sign up for your free Arta account, then visit our "Learning & Events" section to access a recording of our latest information session, "Building Tax Alpha Into Your Portfolio." Prefer a more personal touch? Once you're a member, you can also schedule time with one of Arta's tax professionals at no charge.

With the right approach, you can look forward to celebrating your Done with Taxes Day earlier in the year and enjoy the benefits of your hard-earned salary sooner.

Do you want in?

Create an account in an instant

Sharing is caring

Disclosures

We believe the information presented to be accurate as of the date published and such information may not be updated in the future.

The information contained in this communication is provided for general informational purposes only, and should not be construed as investment or tax advice. Nothing in this communication should be construed as a solicitation, offer, or recommendation, to buy or sell any security.

Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Arta Finance or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Copyright Arta Finance 2026. All rights reserved.

Get the latest market trends and investment insights