Using technology to unlock the “financial superpowers” of the ultra-wealthy.

Have you ever felt that the ultra-rich manage their money and lives very differently? Like they’re playing a game on a whole other level?

Well, you’re right. They employ teams of professionals who use sophisticated financial strategies and tap investment opportunities that the rest of us can only dream of. These teams are called Family Offices. These family offices help the ultra wealthy craft their visions of the future. So we thought - what about the rest of us?

We believe that a kickass financial strategy and a stable, secure, happy future shouldn’t be the monopoly of the ultra-rich. Everyone should have a chance to take charge of their financial life in the same way that wealthier people do. So we’re on a mission to do this in the way we know best – by breaking down barriers to sophisticated finance with technology.

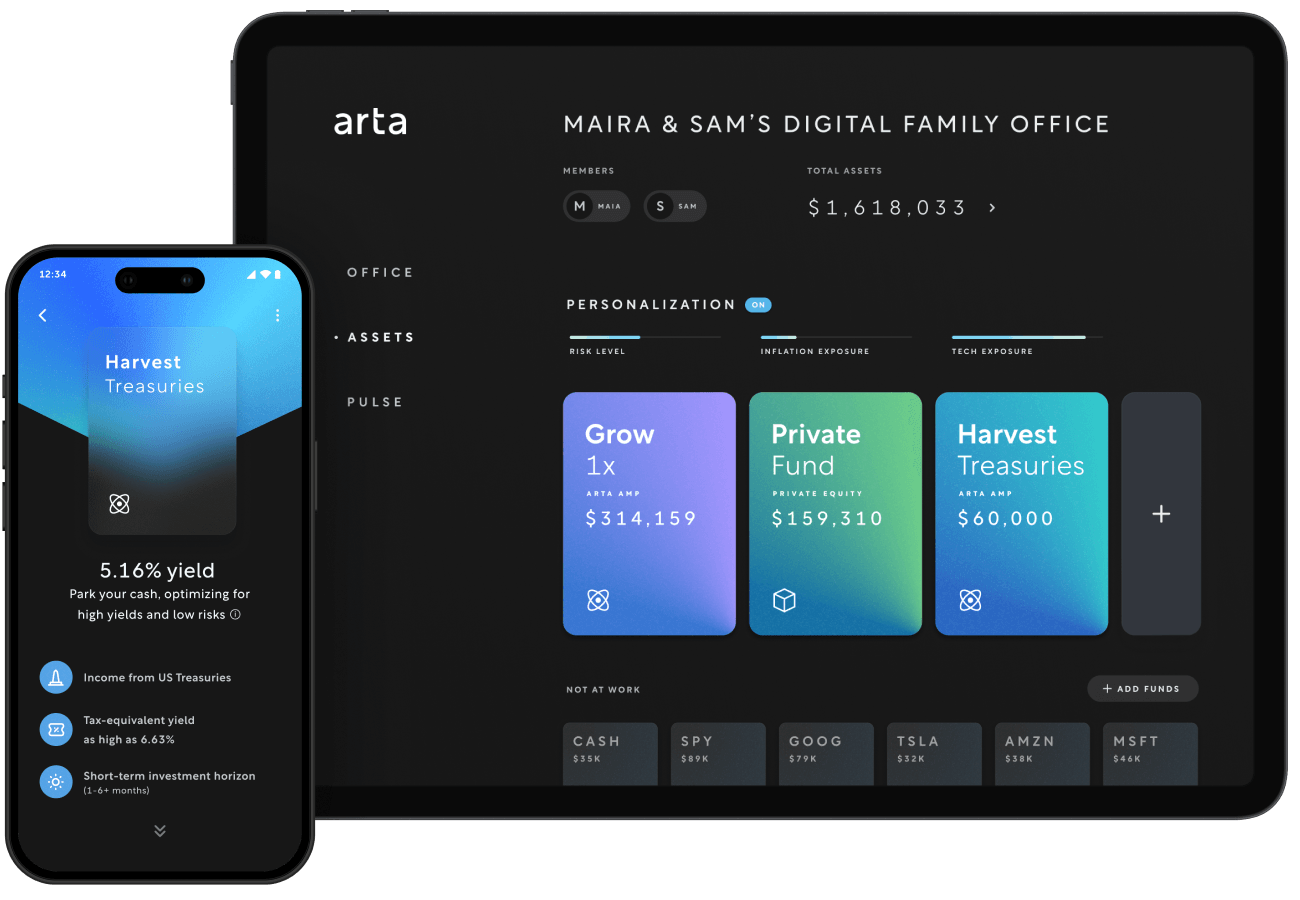

We created Arta to be your financial home – where you can aggregate all your assets, build your personal collection of investments and access expert services to shape your financial future. We got rid of the admin overheads, salesy calls, clunky UIs, and eye-watering fees. And we’ve harnessed AI to enable intelligent investing in public markets and opened access to alternative assets such as private equity, venture capital, and real estate funds. And we plug you into our ecosystem of financial and lifestyle professionals who can help you protect and enjoy your wealth.

Arta is your digital family office

Your Arta financial superpowers

As an Arta member you will be able to:

Access Alternative Assets like Private Equity. Arta will let you invest into previously inaccessible categories like private equity, venture capital, private debt, and real-estate funds. Start investing with as little as $2,500 in alternative investments. We’re offering funds from top-10 fund managers who have consistently delivered high returns over the last several decades.

Create your own personalized investing game plan. Arta’s proprietary AI-Managed Portfolios (AMPs) will enable members to create highly personalized, automated portfolios using stocks, bonds, options, and leverage. AMPs aim to deliver better risk adjusted returns than alternatives like ETFs, Direct Indexes, or most Robo-advisors - all while keeping fees low and transparent.

Get liquidity without selling stock. Eligible Arta members can access a line of credit against their assets at industry-leading rates. This means you can stay invested in the market instead of selling your stocks at the wrong time for a short-term expense, like a house downpayment or tax bill.

Get savvier together. The ultra-rich also gain an edge by sharing financial know-how with each other. You will be able to have your own enriching conversations in Arta Pulse. These verified and private spaces are where members can discover new financial opportunities, benchmark themselves and learn from what their peers are doing.

Invest with confidence. Arta is an SEC-registered investment advisor (RIA) and we have engaged with one of the world’s most renowned financial institutions, BNY | Pershing, to act as our broker-dealer and custodian. Together, BNY | Pershing and Arta share a deep focus on information security. Arta team has applied multiple decades of experience building highly secure and robust products at places like Google, building Arta on top of the Google Cloud Platform and storing and protecting data at rest and in transit with AES-256 encryption. Arta employs password-less, biometric and hardware-based authentication, ensuring members have a safe yet simple experience of using Arta on their phones and on the web.

Align interests with performance-based fees. Arta starts with clear and transparent pricing so members know exactly how the fees work. You pay no trading commissions or custody fees, and qualified Arta members will be able to choose performance-based pricing so they can align Arta’s incentives even more tightly with their goals.

Ready?

We are building Arta for the world and for everyone. But every long journey must start with a first step. Arta is available in the US today to Accredited Investors, and once we obtain the necessary approvals we’ll be expanding to other countries and more users. As we scale, we’ll be opening up gradually and deliberately to ensure every Arta member has a great experience. Let us know if you want in, and we’ll work with you to make sure your arrival reflects the best possible experience we can give you.

Our mission is to make personal finance simple, accessible, beautiful, and maybe even fun.

To do this we have assembled a team of product builders, machine learning researchers, investment professionals, and business leaders who are eager for meaningful change. Over the course of the last year, we’ve acquired MoneyMinx.com, set up the Arta Foundation with 2% of our founding equity, and raised over $90M from Sequoia Capital India, Ribbit, Coatue, and over 140 angel investors including luminaries from tech and finance like Eric Schmidt, Betsy Cohen, Michael Miebach, and Jeff Dean. We’re immensely grateful and honored to have each of these visionaries and believers on the journey with us.

We’re excited to unveil Arta Finance to the world today. While this is just the start, we see tremendous opportunity in using AI and ML to help people build the financial future they want. By building a new kind of financial institution that harnesses deep technology to put its members first, we will make the power of finance available to everyone.

The Arta Team!

Do you want in?

Create an account in an instant

Sharing is caring

Disclosures

We believe the information presented to be accurate as of the date published and such information may not be updated in the future.

The information contained in this communication is provided for general informational purposes only, and should not be construed as investment or tax advice. Nothing in this communication should be construed as a solicitation, offer, or recommendation, to buy or sell any security.

Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Arta Finance or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Copyright Arta Finance 2026. All rights reserved.

Get the latest market trends and investment insights