High-Yield Cash Reserve

Put your cash to work

3.97

% yield

Earn income from US Treasuries with no state tax on returns and no lock-ups. Put your cash on autopilot while High-Yield Cash Reserve targets the optimal rate – in any market environment.

Earn more

More than 9X the average national savings rate.✱

Save on taxes

Potentially keep more earnings, after tax.

Low risk

Invest in U.S. government backed securities with the assurance of SIPC protection for up to $500K.✱

Access funds easily

No-lock up period, which means that you can move funds in and out of High-Yield Cash Reserve when you want

I want to earn more on

$25,000

| Investment | Annual percentage yield | Estimated annual earnings |

|---|---|---|

High-Yield Cash Reserve | 3.94% APY 3.97% 30-day SEC yield | $985.00 |

High yield cash account Wealthfront Cash | 4.00% APY✱ | $1,000.00 |

High yield savings account Capital One 360 Performance Savings | 3.70% APY✱ | $925.00 |

Traditional savings account Chase Savings Account | 0.01% APY✱ | $2.50 |

Arta Finance is not a bank and High-Yield Cash Reserve does not represent a bank account. The comparisons made above are for illustrative and comparative purposes only. High-Yield Cash Reserve is not FDIC insured, and instead are SIPC protected. See disclosures here.

Superpowers for your savings

Optimize returns effortlessly

Get more from your cash in a few clicks. High-Yield Cash Reserve automatically reallocates and rebalances its portfolio to strengthen yields. No need to manage multiple US Treasury products to achieve high yield.

Boost after-tax returns

Income from US Treasuries is free from state and local taxes, which means you get to keep more in returns compared to savings accounts and money market funds.

No strings attached

No sneaky requirements like recurring deposits or compulsory investment periods. Withdraw without penalty at any time.

Park your cash safely

High-Yield Cash Reserve is insured up to $500K by SIPC. Plus, High-Yield Cash Reserve is composed of ETFs that hold treasury securities backed by the U.S. government. ✱

Pay zero state taxes

Dividends from High-Yield Cash Reserve do not incur US state and local income tax. Depending on where you live and your tax situation, a high-yield savings account would need as high as 5.06% APY to have the same after-tax return as High-Yield Cash Reserve.

I’m from

| Investment (California) | Pre-tax earnings on $25K | Post-tax earnings on $25K for the highest tax bracket |

|---|---|---|

| High-Yield Cash Reserve - 3.94% APY 3.97% 30-day SEC yield | $985 | $495 |

| High Yield Savings - 4.00% APY | $1,000 | $503 |

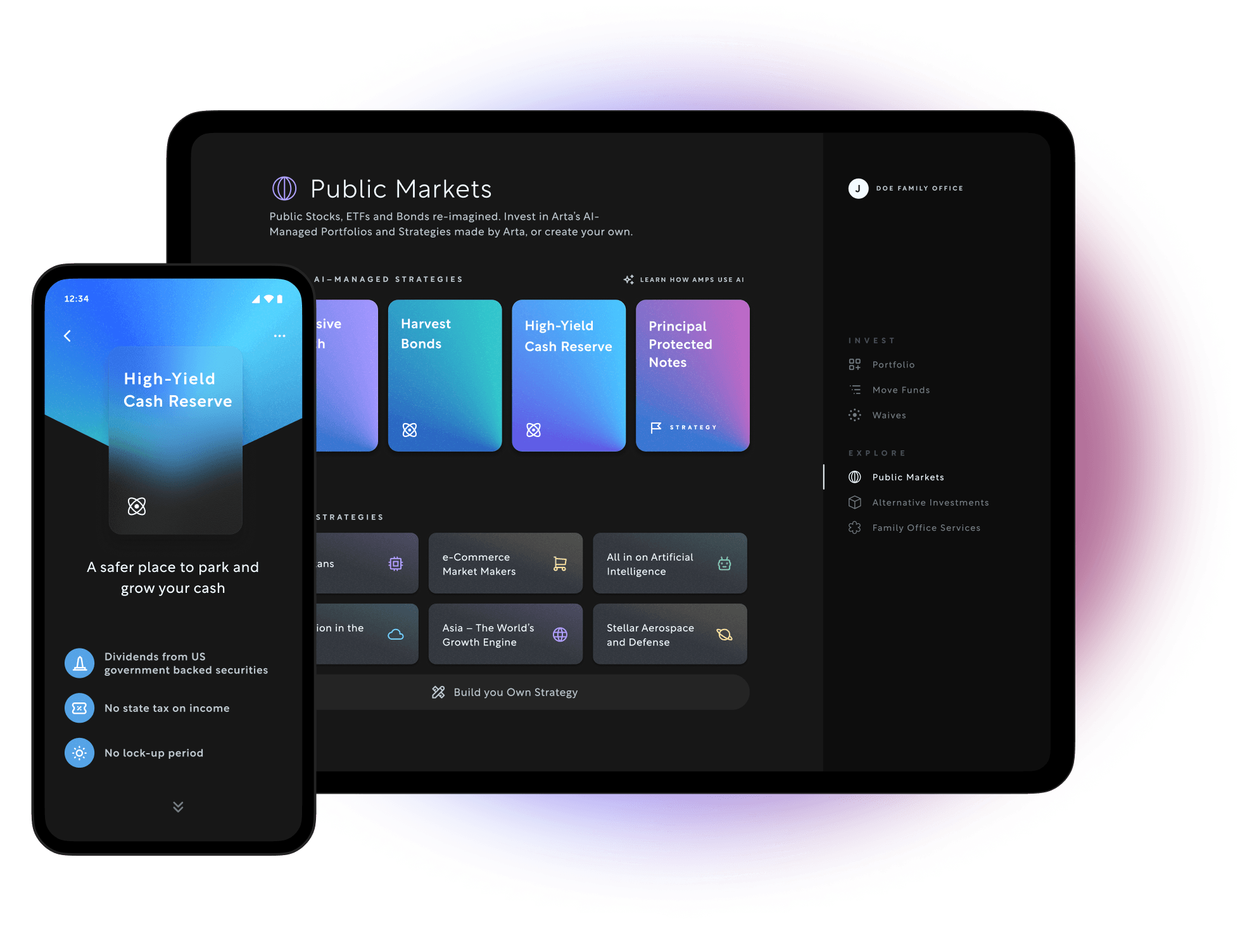

Don’t stop at cash

Your savings have a home at Arta, and so does the rest of your financial life. By joining Arta, you’ll automatically gain access to specialized and top-tier alternative investments like private equity, real estate, private credit, and venture capital, as well as intelligent ways to invest in public markets.

Got questions? We have answers

Don’t see your question answered? Get in contact with us.

Get the latest market trends and investment insights