tl;dr

Temporary market rebounds do not resolve deeper risks. Tariff-driven disruptions are fundamentally reshaping expectations for inflation, growth, and earnings.

We see three possible scenarios ahead — a diplomatic de-escalation (the good case), a prolonged economic stalemate (the bad case), and an all-out trade war (the ugly case) — each with very different portfolio implications.

Diversification is essential for long-term resilience: a well diversified portfolio across asset classes and geographies allow different components of your portfolio to complement one another through various market cycles

Your portfolio’s structure matters now more than ever. Use the core to stay grounded and the satellite to be nimble, adjusting to market dislocations as they unfold.

Recent announcements around sweeping U.S. tariff increases have led to heightened uncertainty and renewed volatility in global markets. In times like these, it’s natural to feel unsettled. That’s why it’s especially important to step back and view these developments through a broader economic and historical lens. By grounding ourselves in context, we can better navigate the noise and stay focused on long-term, thoughtful investment decisions that align with your goals and allow you to take advantage of pockets of uncertainty.

The Arta team has put together a digest of what’s happening, along with three scenarios that might play out.

Of course, these are early days and we’re still closely monitoring events. If you have specific concerns or are considering adjustments to your portfolio, our team is here to support — reach out to us if you’d like more guidance.

Let’s start with where we are now

With markets experiencing their largest one-day rally since 2008 on April 9, it might help to recall how this happened. Following President Trump’s tariff announcement on April 2, markets experienced sharp swings – the S&P 500 fell nearly 10% over two days, entering correction territory, with tech and large importers leading the decline amid fears of global supply chain disruption. International equity markets also dropped, with broad-based weakness across Europe, Japan, and Hong Kong reflecting growing investor unease.

However, sentiment shifted abruptly on April 9 after the administration announced a 90-day pause on reciprocal tariffs for most countries. The S&P 500 rebounded, cutting its year-to-date loss to ~7%. The Nasdaq, which had fallen over 20% from its recent highs into bear market territory, surged ~12% — its biggest one-day gain since 2001. The Russell 2000, a barometer for small-cap stocks, also recovered partially but remains down ~14% year-to-date, underscoring ongoing pressure in more domestically oriented names.

Beyond equities, markets saw a strong flight to safety after the April 2 announcement. Treasury yields dropped below 4% for the first time since October 2024, with the 10-year yield hitting 3.92% on April 3 before bouncing back to 4.28% post-pause. The VIX spiked to its highest level since 2020 before recording its sharpest single-day drop on April 9. Meanwhile, the U.S. dollar weakened on global growth concerns and gold surged to a record high of $3,167.57/oz, where it continues to hover as investors remain cautious.

Source: Bloomberg, updated as of April 9th 2025

Detailed Economic Context: Recent Tariff Developments

In April 2025, the U.S. enacted sweeping tariff increases under President Trump’s “Liberation Day” policy, marking one of the most aggressive trade policy shifts in decades. These actions raise the average effective U.S. tariff rate from ~5% to over 25%1, representing the largest increase in over a century. As with most broad-based tariffs, the economic impact is expected to be felt through higher costs for consumers and businesses, weakened demand, and global supply chain disruptions.

Here is the rundown of tariff developments:

On April 5, 20252

A 10% minimum tariff was imposed on all imported goods.

On April 9, 2025

Additional reciprocal tariffs targeted countries with the largest U.S. trade deficits: +34% on China, +24% on Japan, and +20% on the EU.

Shortly after, the U.S. introduced a further China-specific tariff increase of 50 percentage points, bringing the effective tariff rate on certain Chinese goods to 104%

The E.U. approved retaliatory countermeasures against 25% tariffs imposed by the U.S. on steel and aluminum. This would come into effect on April 15, 2025.

Canada’s 25% auto tariffs took effect on U.S.-produced vehicles and many parts in American cars and trucks.

President Trump announced that he is immediately raising U.S. tariffs on Chinese imports to 145%.

President Trump announced a 90-day tariff pause for other countries. Tariff levels for these countries will be brought down to a universal 10% during that time while negotiations are ongoing.

As anticipated, financial markets initially responded negatively to the sweeping tariff announcements, driven by concerns over rising input costs, supply chain disruptions, and a potential slowdown in global economic growth. Sectors most exposed to international trade — such as technology, autos, and manufacturing — were particularly impacted. However, sentiment shifted abruptly on April 9 when President Trump announced a 90-day pause on tariffs for most countries. The announcement triggered a sharp rebound in equities, with the S&P 500 posting its strongest single-day gain since 20203. This dramatic turnaround highlights the heightened uncertainty and policy-driven volatility investors are facing, with markets remaining highly sensitive to evolving trade developments and geopolitical signals.

Historically, episodes of similar magnitude, such as the dot-com crash (2000-2002), the global financial crisis (2008-2009), and the early COVID-19 pandemic era (2020), highlight the recurring importance of disciplined, diversified investment strategies and staying the course. Such strategies have consistently helped investors manage volatility and ultimately participate in market recoveries.

How Should We Think About Tariffs?

While tariffs are often introduced as tools to address trade imbalances and protect domestic industries, they can also have broader economic effects — such as raising input costs, which may impact consumer prices and business investment. On the other hand, tariffs can incentivize domestic production and create new business opportunities for local companies by reducing reliance on foreign suppliers and encouraging investment in key sectors. The scale of the recent announcements suggests there could be meaningful implications, but much remains uncertain: how long the tariffs will remain in place, which countries may negotiate, and whether these measures will become permanent. In this section, we explore how tariffs may influence key areas of the economy — helping us monitor the factors that will shape the path ahead.

Inflationary pressures are front and center

By raising import costs, tariffs act like a consumption tax. Analysts estimate they could push PCE (Personal Consumption Expenditures) inflation up by 1–1.5 percentage points this year, particularly in Q2 and Q3 4. This would hit purchasing power — especially for lower- and middle-income households. The revenue impact is estimated at nearly $400 billion, or 1.3% of GDP — the largest U.S. tax increase since WWII.

Weaker purchasing power could slow spending

As real incomes decline, consumer spending — which accounts for nearly 70% of U.S. GDP — is at risk of contracting. With savings rates falling and uncertainty rising, the likelihood of further demand weakness is increasing. We will be closely monitoring consumer behavior in the months ahead, as it remains a key signal for the broader economic outlook.

Business investment would also be under pressure

Uncertainty about the duration of tariffs and the potential for retaliation is already weighing on corporate decision-making. Equipment investment is slowing, and forward-looking indicators like the Manufacturing Expectations Index are trending lower. Supply chain disruptions — particularly in sectors like autos and semiconductors — add to the downside risk. We’re closely watching business sentiment, which remains a key indicator of where our economy is headed

Growth could be at risk if conditions persist

If elevated tariffs remain in place for an extended period, the combined drag from weaker consumer spending and more cautious business investment could materially slow U.S. economic growth. JPMorgan now forecasts a 0.3% contraction in U.S. GDP for 2025, while Goldman Sachs has lowered its growth projection from 2.4% to 1.7%. Morgan Stanley has also revised its estimate down from 1.5% to 0.8%, reflecting growing concerns over the economic fallout from sustained trade tensions. Furthermore, as of April, major financial institutions have raised their recession probabilities for 2025 to a range of 25%–60%5, citing heightened global vulnerability and policy uncertainty. While much will depend on how trade negotiations evolve, we’re closely monitoring consumer behavior and business sentiment as key indicators of where the economy may head next.

Can the Fed help?

While rate cuts are being priced in, the Fed is likely to wait for clearer signs of slowing growth. For now, policymakers remain cautious as they assess the full impact of tariffs on inflation and the economy.

Bottom line:

Tariffs at this scale are more than just trade policy — they represent a major economic dislocation. The lack of clarity around how long they will remain in place, how negotiations may unfold, and how other countries will respond only adds to the uncertainty. This environment makes it especially important to understand the range of possible outcomes and how different scenarios could impact portfolios.

So, where do we go from here?

The path forward is highly uncertain – negotiation remains possible, but the outlook is unclear

While the economic effects of the new tariffs are starting to unfold, the ultimate trajectory will depend not just on their duration, but also on how global trade partners respond. President Trump has signaled openness to negotiation, but without a clear framework, it’s uncertain whether these tariffs are temporary bargaining tools or more permanent policy shifts. Some countries have vowed to retaliate, while others appear open to dialogue. As in past trade conflicts, this could result in either a de-escalation to more manageable tariff levels — or, if negotiations fail, a sustained drag on global growth.

Full implementation would be a significant economic shock

If these tariffs are fully put into place and kept in effect for an extended period, they could have a material impact on the economy — potentially tipping both the U.S. and global economies into recession. We’re already seeing signs of softening consumer spending, and that could worsen if uncertainty continues. Companies may also respond by pulling back on stock buybacks, delaying investments, and slowing hiring. In more severe cases, layoffs could follow.

There’s also a growing risk of stagflation — where the economy slows but prices continue to rise — which makes it harder for both markets and households to navigate. One signal to watch is the 10-year U.S. Treasury yield. If it continues to drop, it could be a sign that the bond market is increasingly concerned about recession risk ahead.

Eyes on earnings season for more clarity

With no clear timeline for resolution, much now depends on how much economic stress the administration is willing to absorb and how trade partners respond. The upcoming earnings season could provide fresh insight. We’ll be watching closely for management commentary on hiring, capital spending, and demand outlook. Early signs suggest downward revisions to earnings forecasts for this year and next are likely.

In short, the situation is fluid. While a negotiated resolution could stabilize markets and economic expectations, the risk of drawn-out disruption remains. As always, staying diversified, patient, and focused on long-term fundamentals is key.

Possible scenarios: Tariffs, Markets, and Positioning

With so much still unknown — from how long tariffs may stay in place to how global trade partners might respond — it’s useful to consider a range of potential outcomes and how different parts of the market could be affected. In the following section, we explore three possible scenarios based on historical precedent and current market conditions, along with sectors and asset classes that may be well-positioned in each environment.

Scenario 1: Diplomatic de-escalation and market recovery (the good case)

Scenario 2: Prolonged economic stalemate (bad case)

Scenario 3: Escalation into a Full-Scale Trade War (the really ugly case)

Scenario 1: Diplomatic De-escalation and Market Recovery

Historically, resolutions of trade conflicts — such as the U.S.-China partial agreement in January 2020 — have led to swift recoveries in investor sentiment and market performance. Reduced trade barriers lower costs, improve corporate margins, and restore consumer and business confidence, quickly translating into increased economic activity and market optimism. Below are key beneficiaries in this scenario:

Public Equities:

A de-escalation in trade tensions and return of risk appetite would likely drive broad-based gains in global equities, with growth stocks and cyclical sectors leading the recovery. Below are key sectors poised to benefit:

Technology: Relief in supply chain constraints and reduced import costs typically accelerate recovery in semiconductors, hardware, and software sectors.

Consumer Discretionary: Improved consumer confidence boosts discretionary spending in luxury goods, travel, and entertainment.

Industrials: Increased trade activities stimulate demand for manufacturing equipment, logistics, and infrastructure investments.

Financial Services: Greater economic certainty improves credit conditions, increases business lending, and revitalizes investment activity.

At Arta, tax loss harvesting strategies that follow broad market indexes like the S&P 500 offer efficient exposure to broad U.S. equity markets, while robo portfolios provide diversified access across equities and fixed income. For those seeking upside participation with built-in protection, structured products may offer equity exposure with downside buffers. Additionally, Satellite strategies could provide targeted exposure to certain sectors like technology and innovation, with a specific focus on artificial intelligence.

Fixed Income:

A de-escalation of trade tensions may reduce inflationary pressures and dampen the need for aggressive monetary tightening, creating a supportive backdrop for fixed income.

High yield credit: a risk-on environment and stronger corporate fundamentals lower default risk

Emerging market debt: stabilizing global trade flows may attract flows back into emerging market sovereign and corporate bonds

Private equity:

A de-escalation and return to a risk-on environment in public markets would improve exit opportunities for private companies, supporting private equity realizations. In addition, reduced macro uncertainty and improved sentiment help stabilize valuations and increase confidence in deal-making and capital deployment.

At Arta, a diversified private equity fund can help add long-term growth potential to your portfolio by providing exposure across multiple private equity strategies and sectors. Additionally, sector-specific funds — such as those focused on enterprise software — may further enhance growth through targeted investments in high-potential industries.

Venture Capital:

De-escalation, alongside the potential for lower inflation and interest rates, could strengthen the M&A environment — a key driver of liquidity for VC-backed companies. Improved business sentiment and increased capital availability also tend to boost risk appetite, supporting VC fundraising, investment activity, and follow-on rounds.

Private Credit:

A more stable macro backdrop and easing trade tensions support private credit by lowering default risk and boosting borrower confidence. As interest rate expectations ease and M&A activity resumes, demand for flexible, non-bank lending rises. At Arta, funds that offer diversified private credit income exposure or focus on direct lending can help generate consistent income and complement public fixed income allocations during a recovery.

Scenario 2: Prolonged Economic Stalemate

An extended period of unresolved trade tensions — similar to the 2018–2019 U.S.-China dispute — would likely result in persistent uncertainty, a slowdown in economic growth, and elevated market volatility. While a full-blown recession may be avoided, ongoing ambiguity around trade policy could still dampen business confidence and consumer activity. Companies may delay long-term investments and hiring, which would weigh on productivity and limit the pace of economic expansion. Below highlight resilient sectors and asset classes for this scenario:

Public Equities:

Defensive and domestic-focused sectors such as utilities, healthcare, consumer staples tend to outperform in low-growth, high uncertainty environments due to their relative insulation from global trade disruptions and steady demand profiles

Consumer Staples: Steady demand for essentials such as food, household goods, and personal care products provides revenue consistency.

Utilities: Typically maintains stable cash flows and dividend payouts due to predictable demand irrespective of economic conditions.

Healthcare: Consistent demand for essential healthcare services and pharmaceuticals, driven by demographic factors rather than economic cycles.

Defense: Increased government investment in defense often accompanies geopolitical uncertainties and sustained tensions.

At Arta, various public market strategies can enable you to participate in the market through defensive sectors while custom structured products could provide you with income or potential upside with downside buffer.

Fixed Income:

An environment where growth remains sluggish but inflation may gradually cool creates a more favorable environment for high quality fixed income

Investment grade bonds (IG): IG bonds benefit from the search for safety and yield. As inflation moderates, spreads may compress and demand for high-quality credit rises

At Arta, strategies that can provide a broad bond market exposure can also offer income to cushion against market volatility, while cash management products offer enhanced liquidity and a potential safe haven during uncertain economic conditions.

Private credit:

In a prolonged economic stalemate, private credit can offer steady income and take advantage of reduced competition from traditional lenders. As companies seek alternative financing, private credit funds are well-positioned to meet that demand in a slower-growth environment. A diversified private credit strategy can help generate consistent income and add stability to portfolios during periods of economic uncertainty.

Private Infrastructure:

Infrastructure investments tend to offer stable, inflation-linked cash flows backed by long-term contracts or regulated revenue models. In a slow-growth environment, they benefit from ongoing demand for essential services.

Scenario 3: Escalation into a Full-Scale Trade War

In this worst-case scenario, trade tensions escalate significantly, prompting broad retaliatory measures and prolonged uncertainty. Historically, such escalations have severely impacted global trade, slowed economic growth, disrupted international supply chains, and triggered widespread market volatility. As companies adapt to shifting trade policies and rising costs, margins may compress and valuations may come under pressure — especially in globally integrated sectors. These dynamics increase the risk of both recession and stagflation. Below highlight strategically resilient asset classes and sectors for this scenario:

Public equities:

Within the equity market, Consumer Staples and defense sectors tend to demonstrate greater resilience during periods of economic stress and geopolitical uncertainty, offering more stable performance when broader market conditions deteriorate.

Consumer Staples: Demand for essential goods like food, household items, and personal care products tends to remain stable during economic and market stress. In a trade war scenario, their defensive nature, steady cash flows, and relative insulation from global supply chains make them more resilient compared to cyclical sectors.

Defense and Aerospace: Heightened geopolitical tensions traditionally drive greater defense expenditure, benefiting defense contractors and aerospace manufacturers.

At Arta, Satellite strategies may be able to provide you with exposure to the above sectors. Structured products that offer downside protection could also provide you with potential market upside with complete downside protection.

Fixed Income:

During periods of heightened market stress and uncertainty, fixed income—particularly high-quality government bonds—often serves as a stabilizing force in portfolios. These assets tend to attract capital as investors seek safety, income, and lower volatility.

U.S. Treasuries: U.S. Treasuries tend to perform well in risk-off environments, offering safety, liquidity, and potential price appreciation as investors seek refuge from market volatility. This was evident when the yield on the 10-year Treasury note fell below 4% for the first time since Oct 2024 after the tariff announcement.

At Arta, cash management strategies could provide you with U.S. Treasury exposure while other fixed income strategies could provide exposure to U.S. Treasuries as well as the broader bond markets that can generate income to cushion the portfolio.

Commodities:

In times of geopolitical tension and financial market instability, commodities — particularly gold — have historically served as effective hedges and storehouses of value.

Gold: Gold often serves as a hedge in times of geopolitical stress and market volatility, benefiting from its safe-haven status and potential upside if real yields decline or inflation expectations rise.

At Arta, structured products linked to gold offer a way to access this exposure while managing risk and return preferences.

Private Infrastructure:

Infrastructure assets tied to essential services (e.g. energy, utilities, transportation, digital infrastructure) tend to offer stable, long-term cash flows and are less sensitive to economic cycles. In volatile environments, they can provide inflation-linked income and portfolio stability.

Multi Strategy Hedge Funds:

These funds are designed to navigate complex market conditions by allocating across strategies such as long/short equity, macro, and arbitrage. Their flexibility allows them to seek returns while managing risk through periods of heightened uncertainty and dislocation.

Distressed Credit:

A full-scale trade war could increase financial strain on over-levered companies, creating opportunities for distressed credit strategies to invest at discounted valuations. These funds aim to capitalize on mispriced debt and corporate restructuring opportunities during downturns.

Private Equity:

In volatile markets, closed-end private equity funds are well-positioned to deploy fresh capital into repriced opportunities. Managers with long-term horizons and operational expertise can take advantage of dislocations — particularly in resilient sectors. This is supported by data showing that private equity has historically delivered its highest excess returns during periods of elevated public market volatility. At Arta, a closed-end fund focused on technology and government-aligned sectors can help you capitalize on these conditions while maintaining exposure to long-term structural growth themes.

Embracing a Long-Term Investment Perspective

Navigating market volatility requires patience, discipline, and a focus on strategic asset allocation. Historically, investors maintaining diversified, disciplined portfolios not only navigate volatility effectively but also capture long-term growth opportunities.

At Arta, we are deeply focused on long-term wealth management — a philosophy that informs everything we do, from how we design products to how we construct and manage portfolios. We believe that building and preserving wealth requires thoughtful diversification, robust risk management, and a disciplined investment approach. That’s why we evaluate every strategy through a long-term lens, ensuring our members can access complementary investment strategies that work together across different market environments.

This philosophy also guides how we help members navigate real-world portfolio challenges. For those with concentrated exposure to tech stocks, defensive-focused strategies can help diversify away from sector-specific risk while maintaining stock market participation. For members heavily allocated to public market ETFs, introducing private market strategies can enhance portfolio stability and long-term resilience. And for those holding excess cash but hesitant to re-enter the market, structured products can provide a more measured path forward — offering equity upside with downside protection to build confidence while legging back in.

With the scenarios above and the range of strategies available at Arta, we aim to equip you with tools to invest through cycles and uncertainty. Whether you’re looking to gradually re-enter the market with structured products, preserve capital with U.S. Treasuries, or unlock growth potential through private equity, Arta is here to help you stay invested with purpose.

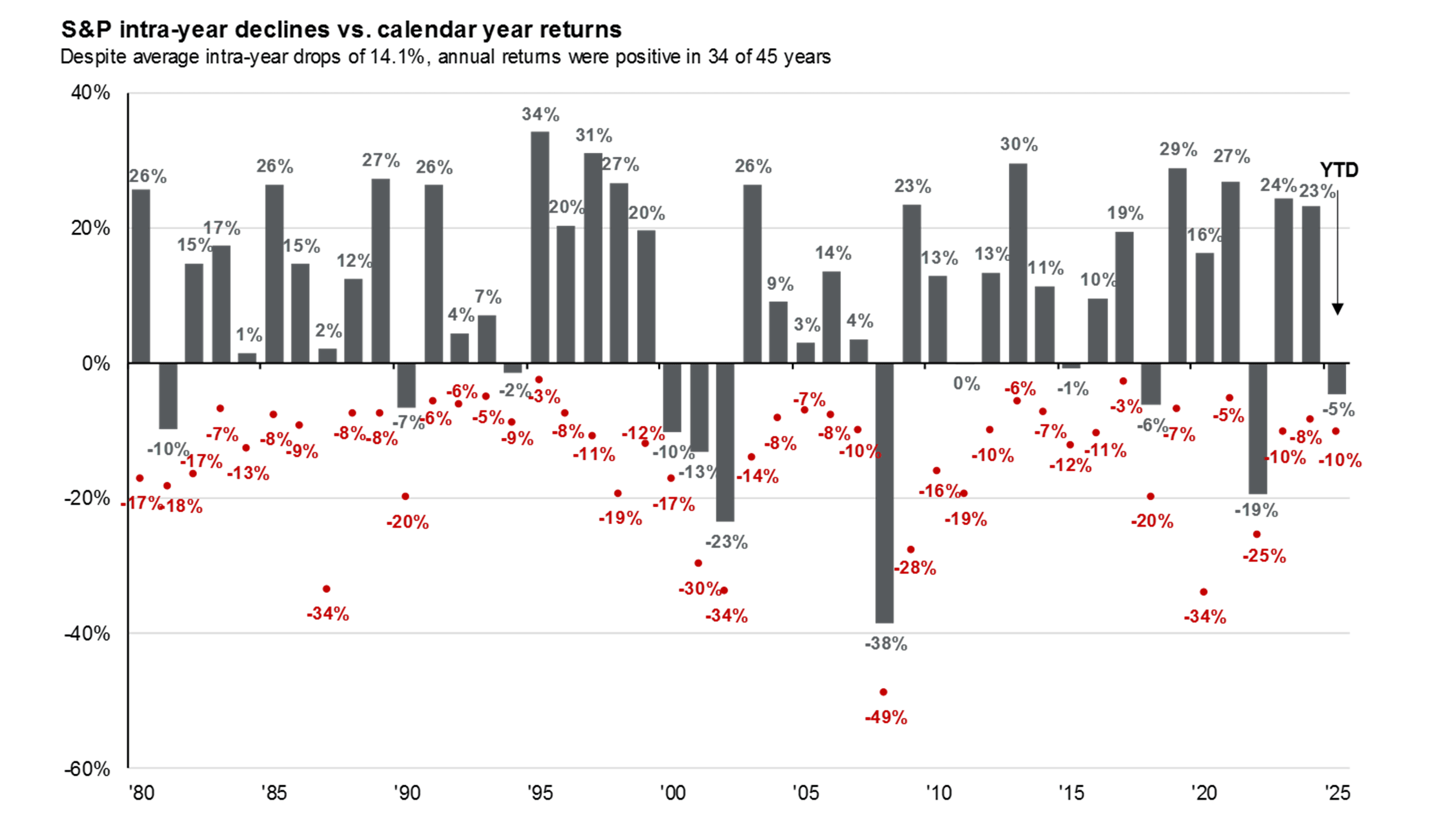

In a market driven by headlines and short-term sentiment, it’s natural to feel the urge to react. But volatility is a normal part of the investing journey (Chart 1). The key is to stay anchored in a clear, long-term framework. Take the time to revisit your core strategic asset allocation to ensure it still aligns with your goals and risk tolerance. From there, your satellite portfolio can be used for tactical or opportunistic adjustments — allowing you to navigate uncertainty thoughtfully and without emotion. With the right structure in place, you can remain resilient and intentional, no matter how noisy the markets get.

For personalized insights or to review your strategy further, please contact your Member Success team or visit your Arta account.

Chart 1: FactSet, Standard & Poor’s, J.P. Morgan Asset Management Guide to the Markets. Returns are based on price index only and do not include dividends. Intra-year drops refers to the largest market drops from a peak to a trough during the year. Returns shown are calendar year returns from 1980 to 2024, over which the average annual return was 10.6%. U.S. data as of March 31, 2025

1. Source: JPMorgan Global Economics, Tax Foundation GS Global Investment Research, April 3, 2025

2. Source: CNBC, April 9, 2025

3. Source: Bloomberg, April 9, 2025

4. Source: JPMorgan and Goldman Sachs, April 9th 2025.

5. Source: Goldman Sachs increased the recession probability from 35% to 45% on April 7th and revised it down to 45%on April 9th. Morgan Stanley assigned a 20-25% range for the recession on March 11th, and JPMorgan increased the probability from 40% to 60% on April 3rd 2025.

Do you want in?

Create an account in an instant

Sharing is caring

Disclosures

We believe the information presented to be accurate as of the date published and such information may not be updated in the future.

The information contained in this communication is provided for general informational purposes only, and should not be construed as investment or tax advice. Nothing in this communication should be construed as a solicitation, offer, or recommendation, to buy or sell any security.

Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Arta Finance or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Copyright Arta Finance 2026. All rights reserved.

Get the latest market trends and investment insights